Factors Impacting Personal Auto Premiums and Claim Costs in 2025

- Written By Dee Dee Mays

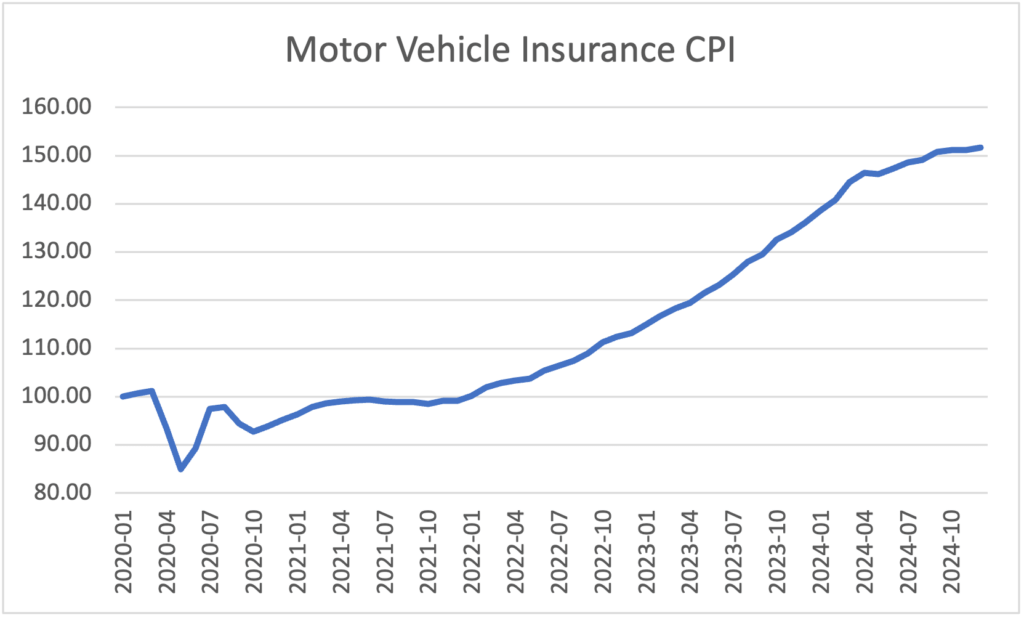

According to the Bureau of Labor Statistics, the increases in auto insurance premiums that have exceeded 15% year over year since March 2023 have tempered in 4th quarter 2024.

Still, the annual change from December 2023 to December 2024 is at 11% – nearly four times the increase in the total CPI during the same period.

What can we expect in the coming year?

Expect Lower Premium Increases

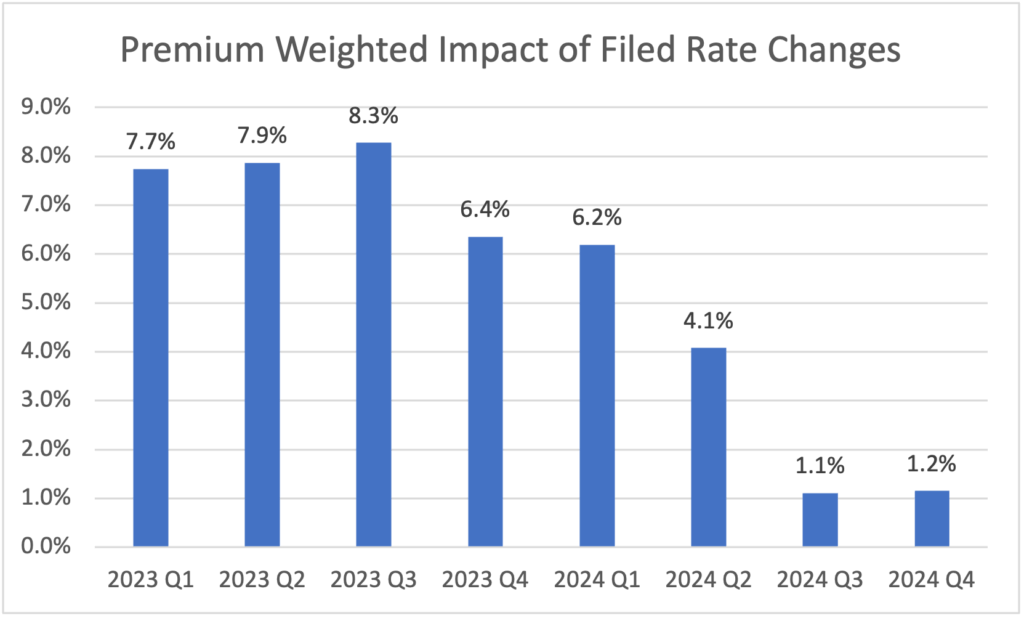

Based on a review of submitted rate filings by Perr&Knight’s actuarial consulting experts, we expect to continue to see lower increases in auto insurance premiums in 2025. Filings available from S&P Market Intelligence as of early January 2025 show that the overall proposed impact of rate changes started decreasing for filings submitted in the fourth quarter of 2023. The declining rate increases continued through third quarter 2023 and stabilized in fourth quarter 2024[1].

Cost Changes Influenced by Multiple Factors

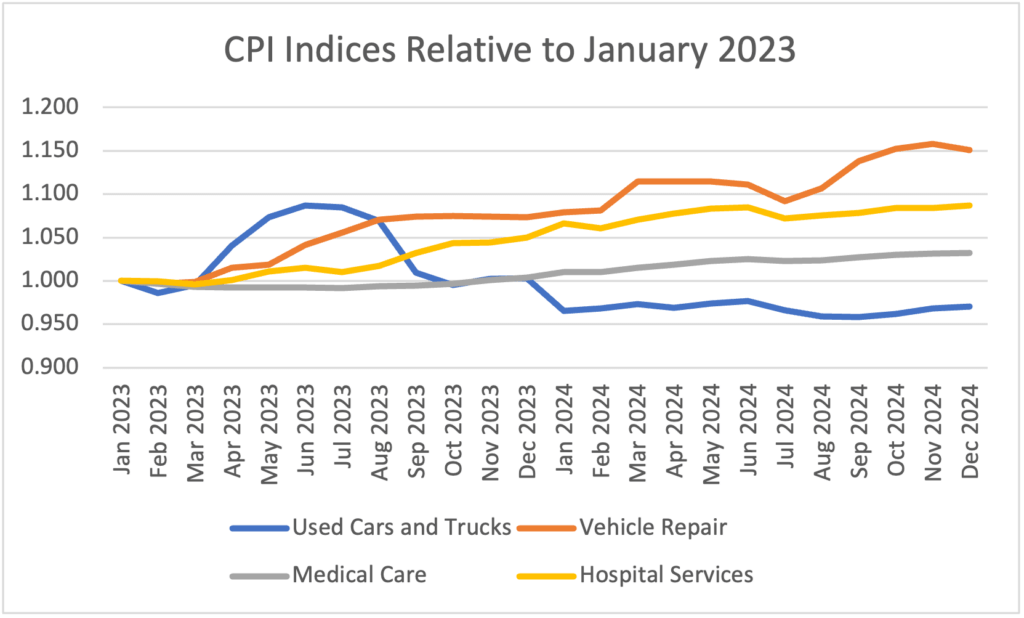

Changes in various CPI indices can give us an idea of the recent changes in the costs underlying auto insurance claims for insurers:

- The cost of used cars and trucks has somewhat stabilized, but is lower for all of 2024 compared to 2023. This would lower the costs of total loss claims, but actuaries also need to consider the impact on salvage recoveries when developing historical losses to their ultimate amounts.

- Vehicle repair costs continue to increase at a higher rate than average costs, despite the improvement in average repair cycle times[2].

- Medical care and hospital services indices have been relatively flat in the second half of the year, which may help control claims costs, including bodily injury.

The change in the frequency of claims is combined with the change in claims severity driven by the items above to determine the total change in costs. The National Highway Traffic Safety Administration recently released some positive news regarding the continued decline in traffic fatalities during the first three quarters of 2024[3].

However, the amount of driving is influenced by fuel costs, which are lower in the second half of 2024, based on CPI data. Lower fuel costs typically increase the miles driven, leading to more vehicles on the road and potentially contributing to a higher frequency of accidents.

Some Higher Premiums and More Shopping

Insureds purchasing policies for the minimum required limit will see their premiums increase in California, Virginia, and Utah. The minimum financial responsibility limits in these three states are increasing effective January 1, 2025. As we have noted previously, the increase in California can be significant. See “Are You Prepared for California’s Increase in Minimum Limits?”

Monitoring of auto rate filings in 2024 by our actuarial consulting experts has shown that some companies appear to be driven to grow their market share by implementing overall premium reductions or offering discounts to entice new business.

One example is GEICO’s introduction of a “Welcome Factor” in most states in 2024. This factor provides a 9% discount for new business relative to the rate for renewal business (prior to considering any caps on rate changes). However, this discount gradually erodes to 6% at first renewal, 3% at second renewal, and then disappears for the third and subsequent renewals. Given this, new insureds with GEICO will see their premiums increase at renewal, absent other changes.

Additionally, consumers are increasing their rate of shopping for auto insurance in 2024. According to TransUnion, shopping for auto insurance increased by 19% in 2024Q3[4].

A Hazy Road Ahead

Unlike 2022 and 2023, when we saw almost exclusively rate increases, 2024 saw some companies implement decreases. The path forward for auto insurance rates in 2025 is not clear.

Some underlying costs have been lower, but there is the potential for tariffs to increase costs for auto insurers[5]. Comprehensive claims will be influenced by changes in the frequency and intensity of weather-related claims. The frequency of property damage and collision claims is also impacted by weather if insureds are driving in less ideal conditions.

Insurance companies should continually monitor internal results, external indices, and competitor filings to ensure that they quickly spot trends that will require an update to their rate levels.

Working with actuarial consulting experts like the team at Perr&Knight can help you evaluate your overall rate need as well as provide detailed analyses by rating variable. In addition, our Predictive Analytics department can provide an automated view of experience by rating variable to visually identify what is driving results.

Contact Perr&Knight today for a review of your personal auto program.

[1] Statistics were compiled through data obtained from S&P Market Intelligence.

[2] J.D. Power 2024 U.S. Auto Claims Satisfaction Study.

[3] Traffic Crash Deaths | Early Estimates Jan-Sept 2024 | NHTSA

[4] 2025 Personal and Commercial Lines Annual Insurance Outlook | TransUnion

[5] Auto Insurance Costs Seen Rising Further With Tariffs – Bloomberg