Introduction

To begin a discussion of excellence in policy operations, we should ask, What differentiates customer-centric from policy-centric operations? Simply put (and to state the obvious), the customer-centric approach places the customer at the center of policy-related processes instead of the policy: a policy is not bound, a customer is bound; a policy is not endorsed, a customer is endorsed, and so forth. As such, it may appear that this is simply an exercise in semantics; it is not.

Consider a business process that sends a welcome letter to a customer the first time a policy is bound for the customer. When business processes, and by extension, business systems are policy-centric, it is difficult to determine whether a policy has been bound for a new or an existing customer. After all, a policy can hardly be “aware” that there are other policies in effect for the same customer. The result is that the welcome letter either is not sent at all or sent each time a new policy is bound.

To illustrate this further, consider a surgeon and his wife who have life, health, automobile, home, and medical-liability policies. The fact is that these policies are most likely written by at least four, and perhaps five different operating companies. In this circumstance, it would be virtually certain that this couple would receive five welcoming letters. Now if two or more of the carriers involved belong to the same corporate parent, this customer will receive multiple letters from what appears to be the same company. If this were the extent of the problem, there would be little issue. However, many more examples of the lack of customer focus exist. Being asked for the policy number when calling in a claim, receiving multiple bills for multiple policies from the same carrier, not automatically receiving multi-policy discounts, having to endorse five policies for a change of address – the list is actually quite long.

The downside is not limited to the customer’s experience. From the carrier’s perspective, even if two or three issuing companies exist under the same corporate parent, it’s highly unlikely that they’re aware of exactly how much revenue they generate from this one customer. Absent this information, individual carriers make decisions without a complete understanding of the organization’s relationship with a customer; as such, significant opportunities for revenue may be foregone.

By contrast, if all of the related companies adopted a customer-centric policy administration model, all of the information about an individual customer would reside in one place. Not only would just one welcome letter be sent out, but the customer would actually receive thanks and discounts for buying from the same corporate entity as well. The family in our example would receive one bill, and if they moved, they would have to make one request, not five or six, for a simple change of address.

Two clarifications are needed at this point.

First, we are not advocating that carriers offer all lines of business to all of their target customers simply to satisfy them. What we are advocating is that carriers look at customer needs, and determine whether those needs are being adequately met by their current product- and service-related processes.

Second, customer-centric design does not magically transform “bad” processes into “good” processes. Instead, all of the ‘good’ features of the customer-centric approach arise from the process designer asking the question, “What does this (whatever this is) imply from the customer’s perspective?” and “Does this make sense from the customer’s perspective?” In other words, absent a customer-centric worldview, it’s likely that a “customer-centric” system will be deployed that fails to meet expectations.

Disclaimers aside, we’re confident that given adequate pre-implementation analysis, a customer-centric approach will usually deliver better results than a policy-centric approach, and leave the door open for incremental improvements over time.

Who or what is the customer?

To become customer-centric, it is necessary to understand customer needs, divide customers into segments based on shared needs, and finally create insurance product and service offerings that focus on each segment. Before one can do this, however, one needs to correctly define the customer and ensure that all relevant customer attributes are captured and understood.

In insurance terms, the failure to adequately understand and define the customer will cause the carrier to lack awareness of possible insurable assets, exposures, and perils. Over time, this may lead to underwriting losses and stunt premium growth based on product and coverage extensions.

Personal lines carriers

As the outset, a personal lines carrier may define “customer” as an individual. This definition, however, works only in limited circumstances, most often where single people require coverage. However, when an individual gets married or begins to share a residence with someone, the definition of customer ostensibly changes to “family-unit” or “household-unit.” To revisit our earlier example, a couple insured by the same carrier that receives two bills for auto insurance may no longer find this acceptable (nor practical, given the discounts that may be available adding insureds to existing policies). As such, a customer-centric carrier would do well to support a “consolidate billing” transaction, something which may be foreign to a policy-centric worldview. Divorces or other breakups as well may cause the customers (now plural) to ask their carrier to segregate the consolidated bill into two, mandating a “split billing” or a “split policy” transaction.

Further, considering the person who also maintains a trust for the benefit of his children that owns some of that person’s insurable assets (e.g., a vacation home), the personal lines carrier has to deal with an additional complication in accounting for an entity – the trust in this case – as part of the customer definition.

Additionally, we have issues of family hierarchies. A teenage child who leaves home and goes off to college with the family car introduces yet another complication. While at some level, the student is covered by policies of the parent household, she may need to eventually split off and become a new, although related, household.

Finally, we have the fact that families may own a wide variety of assets that require insurance. These include the usual homes and cars, and also include exotica such as collectible cars, RVs, mobile homes, boats, etc. As such, when selling a liability policy to a customer, it is recommended that the insurance company be aware of these assets.

Based on the above, we can identify several customer-based processes that can be initiated both by the customer and the carrier:

- Child leaves for college – implies potential out of state auto coverage, either through the parents’ carrier, or through a partner that writes in the state where the child is moving. This presents an opportunity to market apartment rental coverage as well as health coverage to supplement the university health plan, again by the same carrier or a partner. The key here is to make this easy for the customer.

- Family Moves – implies changing the address and risk locations once, which then triggers the creation of appropriate endorsements. Moves also present an opportunity to insure the family’s possessions during the move. Again, the key is to make this process easy for the customer, as well as the agent or broker who represents the customer.

- Family buys a home – this is an opportunity to sell not only homeowner’s, but also title and other types of insurance. Additionally, there are many insurance opportunities in the renovations that most families perform on the homes they buy.

Before going on to commercial lines, we’d like to point out that these examples are not exhaustive, rather just a few of the many changes that personal lines customers experience that present opportunities for the insurer to expand the relationship. In addition to making the process of reflecting these changes to their coverage simple, this level of service offers real utility to the customer.

Commercial lines carriers

In addition to the ownership, hierarchy, and asset issues of personal lines, commercial lines also add the complexity of business entity to the mix.

Businesses can take many forms. Sole proprietorships, partnerships, limited liability companies and corporations are just a few examples. The assets of a business entity, particularly the larger ones, tend to be more complex than those covered by personal lines. In addition, the activities of a company are far more diverse and risk-laden than those of individuals. As a result, the customer definition becomes substantially more complex, since these activities, while creating new exposures and perils, also provide opportunities to provide coverage.

Personal & commercial lines carriers

If we consider carriers that offer both personal and commercial lines, the definition of a customer becomes even more complex, since an individual may be part of a household that is the owner of several personal lines policies. However, the individual may also be the owner, partner, or significant shareholder of a business that has an additional set of commercial lines policies. Unfortunately, personal and commercial lines systems tend to operate independently. No matter how comprehensive the definitions of personal and commercial customers, the lack of connectivity between these systems complicates the policy administration process considerably for individuals requiring personal andcommercial lines coverage.

Customer definition inputs

It should be clear from the above examples that the definition of the customer is perhaps the most important decision that process designers at insurance companies can make.

Unfortunately, there is no one good answer or solution for insurers, since the complexity of customer definition depends entirely on the carrier’s book of business, product offerings and expansion plans. However, no matter how focused and specific a carrier’s offerings and target markets, there is absolutely no excuse for not focusing on the customer. It is also advisable to consider the following criteria:

From the customer’s perspective:

- What are the customer’s needs?

- What are customer’s service expectations from the carrier?

- How is this likely to change with time? (e.g., an auto policy customer replaces his car, a homeowner’s policy customer pays off her mortgage, etc.)

- How is this likely to change due to the customer changing status? (e.g., if an individual client gets married, a small company becomes larger, a company expands overseas, etc.)

- What are the implied customer originating processes?

From the carrier’s perspective:

- What information does the carrier need from a customer relationship management perspective?

- What information does the carrier need from an underwriting and rating perspective now?

- What information is the carrier likely to need from an underwriting and rating perspective in the future?

- What are the various carrier originated processes? How do these interact with the customer?

Customer definition

Based on the questions posed above, it should be clear that the customer definition for a carrier that sells travel insurance will be very different from one that sells life insurance, which in turn will vary from a broad-based personal lines carrier. The same is true for a group health carrier catering to the commercial space, a workers’ compensation carrier or a broad-based commercial lines carrier.

There is no single solution that will work for everyone. Excessive complexity will lead to higher process and systems costs, as will a lack of adequate support for the inevitable complexities that arise in systems implementations. Furthermore, process models must take anticipated changes in the marketplace into consideration, because it is unlikely that a suitable model today will be equally relevant two to three years from today.

Changing course: policy-centric to customer-centric

For new companies, the adoption of a customer-centric process model is relatively straightforward, since processes are typically designed from scratch. As long as the “we’ve always done it this way” attitude does not prevail, the company should expect a decidedly easier time than one with an already imbedded policy-centric orientation.

The challenge for firms with established cultures, organizational structures, books of business, processes, and systems is somewhat greater. To increase the likelihood of success, our suggested approach for achieving a transition to customer-centric operations mandates attention to the following areas:

- Culture & organization structure. This is a prerequisite to everything else, since the acceptance of change is highly dependent on a competent and motivated staff that is correctly aligned with organizational objectives.

- Customer definition. A definition of “customer” that incorporates desirable consumers, their attributes and means for measuring how they perceive the insurance company’s offering and processes.

- Product gap analysis. A definition of how a carrier’s products (or their packaging) might be enhanced to make them more attractive to customers.

- Process gap analysis. Defining the gap between existing processes and the processes needed to sell and service insurance to customers, to ensure that customers are satisfied by the outcome of these processes.

- Systems gap analysis. Defining the gap between the services provided by existing systems and those needed to adequately support the processes defined above.

- Process/systems conversion. Migrating existing processes and systems to the new model.

Culture & organization structure

When considering culture and organization structure, it is instructive to note that the foundation of an insurance business – a policy – is somewhat of a virtual construct. From the insured’s perspective, what is important is the protection of household assets and individuals against certain risks. The fact that insurance companies do this via life, homeowner’s, auto and health insurance policies written by multiple operating companies is not of consequence to the insured. To distribution partners, on the other hand, carriers that handle multiple risks may be preferred, as their worldview tends to already be customer-centric.

Accordingly, carriers would do well to redefine themselves by their target customers. For instance, “We provide commercial lines in Idaho” needs to change to “We cover all risks for Idaho ranchers”. Having done this, the next step is to transmit this message and its implications throughout the carrier organization. While culture change is not within the scope of this paper, cultural considerations are of paramount importance when transitioning to a more customer-centric worldview.

We also suggest that carriers identify a small, committed and competent team of individuals who are influential in their respective groups or departments to drive the remainder of the transformation. Senior managers by themselves rarely have the time or personal influence to accomplish such culture change.

While changing the organization as part of this phase is not strictly necessary, it is useful to consider carrying out some modification in structure to underscore the importance of customer focus.

For instance, personal lines underwriting could be lumped together to create teams, with each team responsible for all policies owned by a certain set of customers. In other words, by using “city” to group customers, one might create a Boston team, a Westchester team and a Providence team – each with home, auto and umbrella underwriters. Having established teams, it would be constructive for each to examine a dozen or so customers from their designated city. It is virtually certain that each individual will learn from the team, and equally likely that the team will devise customer-centric underwriting criteria far superior to line-specific criteria. Much the same can be done with actuaries, marketing, etc.

Another example would be to establish a single relationship manager for each agency or broker across all lines, including personal, commercial, surety, etc. While this is not directly customer-focused, there would finally be individuals within the carrier with a truly broad view of the customers of their allotted broker or agent. In other words, the hope here is that the customer-centric nature of brokers and agents may well rub off on their carrier counterparts.

Customer definition

We have already discussed some aspects of customer definition above. Now, having reached agreement on the definition of the customer and their attributes of interest, the next step is to segment these customers by need.

Customer segmentation by need or other attributes is not a new concept in insurance. After all, in commercial lines, program business is built around product bundles aimed at specific customer segments. Interestingly, however, these programs are often created by brokers, and backed by products, coverage enhancements and risk-mitigation components provided by multiple carriers and service providers. Does program business represent customer-centric nirvana? Quite possibly, though many carriers have not made yet made the leap.

Similar efforts can be seen in personal lines, where segmentation is based on marketing mix, channel and of course, need. Examples include programs based on religion, ethnicity and gender as well as need/channel-based programs such as those designed for military personnel or wealthy individuals.

The point is that no matter how focused a carrier’s offering is today, carrier management personnel need to:

- Understand the customer;

- Understand the customer’s attributes;

- Understand the customer’s needs; and

- Reevaluate the carrier’s offerings in light of these needs.

It is noteworthy that traditional carrier metrics such as combined ratio, loss-ratio, expense-ratio and reserves are really not pure measures of customer satisfaction or the attractiveness of a carrier’s offering from the customer’s perspective. The closest insurance companies come to measuring their customer centric performance is via their retention and hit-ratios. Let’s examine these.

While retention is a significant success factor in high-turnover, competitive markets such as personal auto, in other markets it is a less meaningful determinant of success. Retaining a risk in a non-competitive market merely means that the carrier has not changed its pricing and commission structures in a radical enough way to drive off a customer or the producing broker. Put another way, the carrier has not done anything to overcome the natural inertia of policyholders.

Hit ratio is more interesting in that it measures the attractiveness of a carrier’s offering to customers or distribution partners. However, it represents the combined effect of price and non-price considerations such as commission levels, service quality, etc – and is therefore not a pure-play metric either.

We would recommend coming up with some variations on these, such as “revenue per customer” and “revenue change per customer.” Let’s begin by defining as “customers” (i) all distinct policyholders, (ii) all policyholders who were lost to other carriers, and (iii) any prospect who gets a quote. If we next evaluate the ratio of premium to this number of defined customers, an increase in revenue per customer essentially means that the company:

- Is up/cross selling better;

- Has products that are more attractive to prospects; and/or

- Is able to increase prices without losing customers.

Other process- and customer satisfaction-based metrics include:

- Call volume. Number of customer support calls per customer, number of broker calls per customer, where more calls may equate to poorer service (and lower profitability) as something about the carrier’s processes causes customers or brokers to call frequently.

- Response time. Time to quote, time to issue as a way of measuring the responsiveness of the underwriting process.

- Process automation. Ratio of straight-through processed transactions to total transactions to measure the level to which the process has been made automated.

To conclude, customer definition is not only about understanding and appropriately segmenting the customer, but also about defining metrics that help the carrier shape its offering to meet the expectations of its target customers.

Product gap analysis

Having identified one or more customer segments to target, the carrier must then consider the gap between the product offered and the coverage needs of the segment. As with culture change, product design is beyond the scope of this document, but there are a few points for carriers to consider.

First of all, carriers should decide whether they wish to be coverage focused (e.g., sell workers’ compensation insurance in California) or focus on the broad-based insurance needs of their market (e.g., insure Idaho ranchers). If a broad-based approach is taken, the carrier should attempt to address the coverage real estate adjacent to their current offering. For instance, if Idaho ranchers are missing workers’ compensation and commercial auto from their mix, they should find a partner who is suited to complement the current offering with the missing lines, or at least provide a stop-gap until Idaho ranchers can design and file their own products.

The point is that in order to prevent being commoditized, carriers’ offerings should be differentiated by the target customer. This requires segment-specific coverage enhancements, whether provided by the carrier or a partner. A classic case in point here is Hartford Steam Boiler, which provides the boiler insurance component of many carrier packages.

The point about offerings being capable of being differentiated by the customer is even more relevant in light of the fact that the direct-to-consumer channel is rapidly growing in volume.

Finally, it’s instructive to examine the website of small community banks. Virtually every one of these banks offers checking, savings, investments, bill-payment, etc. In most cases, a majority of these services are provided through OEM arrangements with outside vendors. From the customers’ perspective, however, this third-party relationship is immaterial, since all of their needs are met through a single source.

Process gap analysis

At this stage of a customer-centric transformation we’ve arrived at a clear definition of customers, customer-segments and the insurance products to be marketed to each segment. Now we need to consider the processes through which this mix will be sold and serviced. Since a large number of these processes already exist in one form or another at policy-centric carriers, we will evaluate and contrast them with those mandated by the customer-centric model.

New business quoting

In policy-centric systems, a new business quote is specific to a policy, and typically starts out with some information about the prospective insured followed by information on covered assets and coverage levels. Additional questions that reflect the adoption of a customer-centric orientation include:

- Is the prospective insured or any of the individuals to be covered by the policy already insured by the carrier?

- Was the prospective insured or any of the individuals to be covered by the policy insured by the carrier in the past?

Policy-centric systems cannot really address these questions in any deterministic way. This lack of knowledge can adversely impact the carrier’s relationship with the customer. For example,

- A customer who is cancelled for failure to meet underwriting guidelines may become a de facto insured again by naming his spouse as the insured.

- A person unaware of a multi-policy discount may not receive one, and as a result, may choose to do business with another carrier.

- If someone is applying for a GL policy and the property is already insured by the carrier, requests for location and other asset-level information, such as class codes, industry, etc., may be duplicated. This results in redundant data entry and discrepancies between the assets for the property and GL policies.

- The GL underwriter might want to review property coverages and details when doing an underwriting review – a policy-centric system could not accommodate this.

- If restricted to quoting one line at a time, a carrier cannot effectively put together a customer-centric package of coverages that span multiple policies simultaneously.

- Finally, the issue of coverage duplication and broker of record resolution becomes much more difficult in policy-centric systems.

Separate customers and assets from coverages

The design of customer-centric processes and systems mandates the need to view customers and their assets (locations, vehicles, etc.) as distinct from the coverages associated with one or more of their assets. This unbundling allows customer and asset information to be viewed as a common resource across multiple quotes for multiple lines of business.

Enable multiple, simultaneous lines of business

Separate the process of acquiring customer, asset and exposure information from the concept of lines of business. In other words, the customer should be able to state his needs from his perspective, and the carrier should then bear the burden of determining the product/coverage mix that best addresses those needs.

To visualize this, imagine the user interface required to write a policy for an insured in the plumbing industry. In this case, the insured would not be asked to specify whether they wanted property, GL or commercial auto coverage. Instead, the focus shifts to the assets of the insured, and having identified those assets, the appropriate coverages would be recommended. For a particular location “asset,” therefore, GL, property, crime and inland marine coverages might be suggested based on the fact that the customer is a plumber. If the reader recognizes the similarities of this approach to consumer websites such as Amazon.com or Orbitz®, they’re spot-on, as this is exactly the approach we are advocating.

Emulate TurboTax®…

An excellent model for this design (separating customer needs from the underlying products that satisfy these needs) is TurboTax®.

A key feature of TurboTax® is that it does not ask users to pick the tax forms to be filed, rather, it asks them about their earnings, situation, investments, etc. – and automatically determines the forms that need to be filed. Repeating what we have said earlier, the customer does not care about the distinction between property, crime and inland marine coverage. These are completely artificial divisions invented by the insurance industry that have absolutely no utility from the customer’s perspective.

Secondly, as the process “learns” about and determines the underlying products that represent appropriate coverage, more information is required from the user, but one never has to answer the same question twice. For instance, if a user chooses to pay for e-filing a tax return with a credit-card, they only have to provide this information once, and this information is validated once.

Contrast this with policy-centric systems, where the credit-score is ordered twice, the payment information is entered twice, and basic information such as address, locations, buildings, industry and square footage is entered twice.

New business: quote rejection

Now consider a process which really does not exist for most policy-centric systems – dealing with a quote that was rejected by the prospect or his broker. For a policy-centric carrier, this decision is usually final; a customer-centric carrier, however, has several options.

First of all, if the prospect is already a customer for a different line of business, the carrier must evaluate whether it is worthwhile to give a larger discount to get the additional line. Clearly, if the customer has better-than-average credit and loss experience, this is a very desirable prospect for the new line.

Even if the prospect is not already a customer for another line of business, the carrier now knows a lot about the prospect. This is certainly enough information to determine whether the customer falls into a desirable segment for the carrier. If so, the carrier can re-market the same line on renewal, possibly with better terms or coverage enhancements. In addition, the carrier also has the option of marketing complementary products to the same customer.

Accordingly, we highly recommend this process be added. As with many of the ideas in this document, this is already in place at many brokers and MGAs who employ both automated and manual processes for re-rating and re-proposing coverage many months after the rejected quote’s effective date.

New business: request bind

The point at which a customer or broker requests that coverage be bound is critical. This is because at this point the customer has decided to buy – an excellent time to introduce additional coverages and services.

Particularly when the customer needs multiple policies, the information provided by the customer is usually sufficient not merely to price the desired policies, but also a number of supplemental coverages and other lines of business as well. For example, people buying home and auto insurance have typically provided enough information to quote umbrella.

Given this, the “request bind” process is an excellent place to up- and cross- sell additional products.

Emulate Orbitz®…

People who have booked tickets with online travel portals will notice that when the customer clicks on “buy,” the page returned not only confirms the purchase and flight details, but also

- Offers upgrades at a price;

- Offers better seats at a price; and

- Offers limo service, theater tickets, car reservations, etc.

From an insurer’s perspective, this is analogous to:

- Offering higher limits or lower deductibles;

- Offering additional coverages;

- Offering complementary products.

The point here is that whether the sales process involves a broker, a call-center or the web, the ability to present additional revenue opportunities should be added. We should stress, however, that this up- and cross- selling needs to be designed with the customer segment’s needs in mind – irrelevant offers, or those with limited utility are unlikely to succeed and may actually damage the customer relationship.

Underwriting

If we examine underwriting from a customer-centric perspective, we’re most concerned with:

- Customer specific issues. These include situations where the customer has issues with credit, location, their form of business, etc.

- Customer individual issues. These include situations where one or more individuals associated with a customer has declared bankruptcy, has been convicted of a crime or has more than three similar problems.

- Asset/exposure underwriting. This refers to underwriting the specific exposures of the assets being insured.

Typically, policy-centric processes focus on the third area of concern, often at the expense of the first two. To highlight the industry-wide lack of customer-centric underwriting processes, consider the following examples:

- When underwriting a BOP, how many carriers run credit-checks on each owner and partner?

- While the property line of business requires an answer to the question, “Have you ever been convicted of arson?,” the workers compensation policy does not.

As we pointed out earlier, individuals that own or control insured assets should be considered to be exposures in the same way wind, hail and earthquakes are. A customer-centric underwriting process or operating model implies that:

- Traditional or policy-centric underwriters need to focus on assets/exposures specific to their lines of business; and

- Customer or customer individual underwriting should be performed once per customer as opposed to once per policy.

Billing, payment and collections

Of all functions within the carrier, the billing and accounts receivable groups are likely to be most enthusiastic about customer-centric design. The reason? More often than not they’re the ones criticized for sending multiple bills to the same customer where each bill corresponds to a different policy. This not only increases the number of transactions (and associated costs), but also makes other transactions, such as agent/carrier accounting, more difficult. Furthermore, accounting staff tend to think of this arrangement as counterintuitive, because they see the customer-centric model quite clearly – a unique customer corresponds to a unique billing account, and a unique policy corresponds to a unique receivable.

The trouble lies with policy-centric processes that don’t identify multiple policies as belonging to the same customer. Considering an extreme case, an individual-owned business may wish to consolidate the home, auto, and commercial insurance for a single entity under one bill. This is virtually impossible for a policy-centric carrier.

When using customer-centric processes, all of this becomes much easier, since an integral part of creating a quote or a policy is to identify the customer for whom the coverage is being added. In addition, assuming the carrier opts for a rich customer definition, there should be no issues when associating commercial entities.

Some additional advantages also accrue from becoming customer-centric:

- If payment plans are made consistent across products, billing and payment becomes easier for both the carrier and the customer. In addition, when the customer wishes to change a payment plan, this can be done in one place.

- If the carrier already has EFT details on file for a customer, the same EFT profile can be used for other products that are purchased later. Equally importantly, if the customer changes his bank, changes only need to be made in one place. This is a specific benefit of keeping one or more payment profiles associated with the customer as opposed to the policy.

Emulate Amazon.com…

At checkout, shoppers at Amazon.com are able to add, delete or modify:

- Billing address – the address at which the bill is to be sent or alternatively the billing address of the credit card used;

- Delivery address – the address to where merchandise is to be delivered; and/or

- Payment method – the method of payment (e.g. EFT, credit card, etc.) as well as the associated payment details.

This “on-the-fly” modification of the customer record is only possible because Amazon.comdistinguishes between customers and transactions. More often than not, insurance carriers do not make this distinction.

Clearance

For most carriers, clearance is the process of ensuring that a risk is not being covered twice, and determining whether two brokers have submitted the same risk for the same customer. Based on carrier preference, this may be done up front, or at the end of the process, when the broker or customer requests the carrier to bind a policy.

The challenge with this process in policy-centric systems is that since all policies capture different customer and risk characteristics, clearance is performed in different ways for different policy types. A customer-centric process breaks the account clearance process into two pieces, namely, customer and coverage clearance. Note that this is analogous to the manner in which we suggest segmenting the underwriting process into customer underwriting and coverage underwriting.

Customer clearance is the process of comparing the customer details of two submissions to determine whether we’re dealing with the same customer. This process uses a variety of matching criteria, including social security number, EIN, date of birth and DUNS number in addition to name, address, zip and other contact information. Since this is a problem which is not specific to insurance, there are many third-party data management solutions available.

Coverage clearance is relevant only if two submissions belong to the same customer. This is where the policy/product specific process would determine whether, for example, the same vehicle was being covered by two different policies.

New business issue

The issuance process in a customer-centric world bears much similarity to the policy-centric model. The one major difference is the need to issue multiple policies simultaneously.

Returning to the TurboTax® example, when a user wishes to file a tax return, TurboTax® generates the relevant forms as a single package. In the same fashion, whether delivery of policy forms is electronic or paper-based, it’s important in our customer-centric world to generate all documents for all policies sold to a customer in one consolidated package.

Endorsements

It is typical of most policy-centric carriers to attach endorsements to each policy associated with a customer. This process is done in isolation, with little or no reference to other policies that may be in force for the same customer. This approach has numerous disadvantages. Consider the examples below:

- A carrier has homeowners, auto, and umbrella in force for a customer. The customer endorses the auto policy to add a Ferrari. This is of much consequence to the umbrella underwriter, however, in a policy-centric world the umbrella underwriter would not be aware of this until renewal.

- The customer in the above example moves to a new house. Three policies will need to be endorsed and the same address information will need to be entered three times. This example adds the related concern that the agent may neglect to endorse one of the policies.

Customer-centric processing eliminates both of these issues. An endorsement to the auto (or homeowners) policy could trigger a task for the umbrella underwriter. Note that this is possible only because all three policies are associated with the same customer. In the case of an address change, since all shared asset information is associated with the customer, it only needs to be modified once, and based on the implementation of the process, policy endorsements may be generated automatically. Note that, again, we have broken the endorsement into two parts, a customer endorsement, where some attribute of the customer is modified, such as the address of the covered home; and a coverage endorsement, where we may or may not decide to modify the coverages on this asset.

Clearly, the benefit is that the “customer” needs to be endorsed just once, and not for each policy.

Cancellations & non-renewals: non-pay

In our view, cancellations and non-renewal for non-payment can be classified into three fairly distinct classes:

- Defaulter – where the insured does not have a good payment history.

- Redeemable – where the insured does have a good payment history, but has had extenuating or mitigating circumstances.

- No-fault – where the customer is being penalized for an error or omission by the customer, agent, or carrier.

It should be clear that it is in the interest of the carrier to distinguish between these three cases. The strength of the customer-centric model is that we have the information we need to make good decisions. Let’s consider the three cases in order:

In the case of defaulters, non-payment should alert the carrier that other policies for the same customer may be at risk as well. While carrier actions in this regard are limited by regulation, the carrier can take certain steps such as holding or reviewing all changes to other policies issued to the customer.

Where a late paying customer has previously exhibited good payment behavior across all policies, the carrier should take steps to be more lenient than it might otherwise be. Clearly, leniency is not an issue from a regulatory viewpoint, and helps to secure the customer’s loyalty.

If improperly handled, an inadvertent or a no-fault cancellation could cost the carrier a customer. To avoid improperly terminating an insured, carriers are well advised to look at surplus cash/payments in other policies for the same customer, recent changes in address and other possible sources of error before canceling.

Cancellations & non-renewals – underwriting

Issues with cancellations and non-renewals for underwriting reasons follow the same broad pattern as the non-pay discussion above. Here, our three categories include:

- Bad risks – where the insured is a bad risk and likely should not have been taken on as a customer.

- Good risks gone bad – where the insured was a good risk, but has become a bad risk.

- Misunderstood good risks – where the risk is good, but has been misunderstood.

First, let’s consider the bad risks. These become evident when the carrier discovers that a particular policy needs to be cancelled for reasons associated with underwriting guidelines. In this case, we must clearly distinguish between a bad customer and a bad risk. In other words, there is a difference between an insured who misled the carrier as part of the application process, and another who mistakenly built a house on a hazardous waste site. In the former case, the carrier should do its utmost to rid itself of all other policies for the same customer. In the latter, merely the one with the hazardous waste exposure will do.

For an example of a risk that becomes less attractive over time, consider a manufacturing unit that expands quickly. In doing so, it begins to cut corners on employee training, safety, maintenance procedures, etc. This is clearly a situation where the carrier needs to work with the insured to consider the impact on other coverages provided to the same customer. As with the non-pay situation, working through issues with the carrier will likely promote customer loyalty.

Finally, the issue of alienating a good customer exists if there is a cancellation or non-renewal based on a misunderstanding. Consequently, this must be a well-considered decision based on the attractiveness of the customer as a whole.

We should point out here that many of the above concepts have been tried out successfully in the consumer loan and mortgage industry with very good results. Extending this idea further, we highly recommend that in the context of underwriting customers, carriers examine the practices of consumer loan and mortgage underwriting, since their business is built upon underwriting the ability of their customers to meet commitments. Much the same is true in the case of commercial loans and banking.

Renewals

In a customer-centric world, renewals are viewed in the same fashion as the bind requests discussed earlier. Once the carrier makes the decision to send out a renewal offer to an existing customer or reissue a quote to a prospect who did not accept it previously, the carrier can maximize:

- The chance of renewal or of new business succeeding (in the case of offers to prospects)

- Up- or cross-selling as a way of further expanding the coverage area of the customer, and precluding competitors from muscling in.

We would emphasize that this be done with careful examination of the target customer needs, since both the attractiveness of the renewal offer, and of any up- or cross-selling attempts depends on how targeted the message is.

Process & systems conversion

Once a carrier has determined a change to a customer-centric operational model is in their best interest, the processes and systems required to support the model must be designed and implemented. While technology is front-and-center, at a purely business level there are some cardinal rules to follow.

Shared customer repository

Assuming a well-formed customer definition, the carrier first needs to identify all customers by drawing from policy, billing, and claims systems, and organizing them into one coherent, clean repository. This is a major, necessary undertaking. Outsourcing should be considered here, as there are a number of companies that specialize in this type of work. The same vendor can also be used to maintain the data on an ongoing basis to avoid duplication, erroneous or outdated information or other data quality issues. All other systems, including policy, billing and claims should refer to this repository for all customer-related information.

Stripping away agency

One common misconception in the carrier and agency worlds is that agencies “own” customers. While agents and brokers produce quotes and policies for customers and can therefore be viewed as “owning” the policies, they do not, in fact, have the same ownership over – or responsibility to – the customer as the carrier.

To illustrate this, consider that a customer retains three brokers to acquire three policies from a single carrier. A policy-centric system would treat each policy as a separate “customer.” However, from the carrier’s (accurate) perspective, this arrangement is with a single customer; thinking otherwise negates the utility gained by proper customer definition described throughout this paper.

To be sure, this does create some complications, particularly related to information security since it becomes necessary to hide customer details from certain users (e.g., brokers) not entered by the originating broker. Adding this additional security layer, however, is well worth the extra effort.

Maintaining clean data

Once a carrier creates a clean central repository, both system shortcomings and data entry errors will negatively impact data quality, as duplicates and inconsistencies will begin to pollute otherwise good data. To address this, a staff member (or several staff members) should be made responsible for data integrity and cleanliness against a set of published data quality measures.

The business case

Thus far, we have described the customer-centric model for carriers, contrasted it with the traditional policy-centric model, and walked through the steps one would take to transition from the old to the new model. To conclude this paper, we’ll describe the business case for the customer-centric model.

CRM/customer profitability

As the attentive reader will have deduced by now, much of the content of this paper is the application of customer relationship management principles to insurance. If one strips away the hype around CRM, the simple kernel of wisdom that remains is to do whatever you can to acquire and retain profitable customers, while doing your utmost to rehabilitate or discard unprofitable customers. A precursor to this notion is to recognize and reduce the many ways in which customers cost carriers money.

While insurers routinely use loss ratio as a proxy for customer profitability, it should be noted that customer acquisition and servicing costs have risen to the point where they mustbe considered as well. Both direct and indirect costs are acknowledged in the customer-centric model, as are means of revenue maximization.

Underwriting/rating

The ability to consider all policies from the customer perspective is essential to underwriting. Underwriting considers the desirability of assets owned (or managed) by the insured.

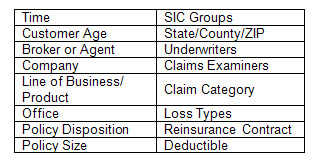

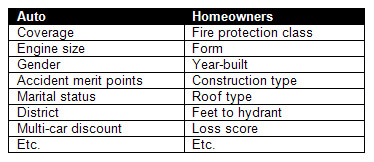

While the focused underwriting of assets, such as buildings or automobiles, and the perils associated with them is important, it is perhaps more important to underwrite the individual or the entity that owns, lives in, operates and/or manages these assets. This point of view is supported by the fact that the majority of new variables added to rating algorithms in the last twenty years involve “human” factors such as credit, age, gender, etc. Additionally, the definition of “customer” as a household is supported by the importance that “additional drivers” now have in automobile rating. The same is true for commercial lines. The credit rating of a company, together with its processes (whether related to cash control, loss control or injury prevention) have become as important as square-footage and protection class in rating and underwriting.

Unfortunately, it is rare to find these additional customer characteristics in process definitions, and even less so in policy processing systems. Another, equally important point is that when these additional customer characteristics are captured and tracked, they are done so at the policy level, suggesting that underwriters reviewing other policies for the same customer often do not have access to this information.

The bottom line is that while individual underwriters may collect and review a wide variety of customer information, this is rarely institutionalized in underwriting processes when in fact it should be. Conversely, neither personal nor commercial lines underwriters adequately underwrite the customer, and instead restrict themselves to the narrow confines of a particular line of business. An extreme example of this is umbrella underwriting, where rarely do umbrella underwriters collect, let alone analyze, all of the details of the underlying policy changes associated with them.

Note that these shortcomings in process are not functions of ignorance or laxity. Instead, they stem from a long held policy-centric view from both a process and technology perspective. Furthermore, the cost and risk (not to mention the unavailability of management capacity) required to undertake this type of change locks the majority of carriers into a policy-centric world.

Given this, the financial impact of the customer-centric model includes:

- Lower underwriting costs. By splitting underwriting into customer and coverage underwriting, we remove redundancies in underwriting customers.

- Lower cross-subsidization. By adding more customer attributes as drivers of rating algorithms, we reduce the coverage cost subsidies that have existed with the traditional focus on assets, perils and exposures, rather than the owners, operators and managers of assets.

- Lower loss costs. Through improved underwriting information, more consistent underwriting guidelines and the early warning provided by the first policy to have a loss on other policies for the same customer, loss costs may be reduced.

Billing/collections & customer support

Single bills per customer cost less to generate, cost less to apply and process, and if the invoice is designed well, provide the customer with answers to frequently asked questions to reduce customer service calls. This is not trivial, since some 70% of carrier service center calls are related to billing inquiries.

Even when a customer does call, the ability for customer service representatives to access all of a customer’s policies and ascertain their billing status, as well as up- or cross-sell relevant or complementary products enhances the utility of call center representatives. More information at a rep’s fingertips means fewer transfers within the call center, faster problem resolution and generally more satisfied customers.

Commoditization

A number of insurance monolines, especially personal lines and the low end of some commercial lines, are becoming commoditized. Direct-to-consumer companies are leading the way, usurping precious market share from traditional carriers who lack direct sales capabilities.

The best counter to this trend is to begin to offer value-added products and services that are highly targeted to specific customer segments willing to pay higher premiums. To put it bluntly, the policy-centric model fails miserably in this sort of world.

Agent/broker/channel benefits

While the direct channel is expanding, agents and brokers are still a necessary component of the value chain, and are likely to remain so for some time to come. For the most part, the customer-centric model suits these players much more than the policy-centric model because:

- A majority, and certainly the more competent members of this community, are already customer-centric. From their perspective it’s far easier to shop for all of a customer’s needs in one place rather than dealing with multiple carriers. This reduces costs for the agent/broker and drives higher marginal revenue for the carrier.

- As the population of agents/brokers ages and individuals with lower skills and less experience are introduced, a carrier that can promote its own products rather than rely on agents to push them is likely to enjoy higher revenues.

- As has been described earlier, the lower cost of policy maintenance in a customer-centric model is also likely to appeal to agents and brokers, since many post-acquisition transactions do not pay commissions.

Conclusion

Many carriers continue to operate using a policy-centric model. We believe that, on balance, these carriers have higher operating costs, lower revenue per customer and are likely to have lower growth rates than their customer-centric compatriots. The customer-centric model is tried and tested in many industries, most notably, perhaps, in banking and consumer finance.

There are tangible benefits associated with a customer-centric model, particularly for multi-line carriers. To realize these benefits, however, carriers need to take a hard look at existing, organizational structures, processes, and systems and the cultures in which they dwell.

This is no easy task, nor is it certain that when they are done, they will be substantially better off than before. However, the cost of not attempting this transformation may be result in an increasing lack of ability to compete or maintain the loyalty of hard-won customers.

Implemented well, on the other hand, the customer-centric model results in substantially lower costs, the ability to significantly grow revenue and profit and a loyal, committed and ultimately satisfied customer base.

Vivek is co-founder and Chief Technology Officer at OneShield, Inc., a process automation software company with an insurance industry focus. Prior to OneShield, Vivek worked in a variety of technology, marketing and consulting positions in the financial services industry. His industry experience spans some twenty years. Vivek was educated at Swarthmore College and INSEAD.