The travel landscape has shifted dramatically over the past two years. From travel disruptions resulting from coronavirus variants to the recent surge in gas prices to the abrupt decline in both travel insurance sales and claims, it’s been a wild ride for travelers and insurance companies alike.

Here’s what has changed in the travel market over the last two years, how these changes have influenced today’s travel insurance product development, and what we expect to see moving forward.

Flights as a measure of travel insurance health

Looking specifically at the number of flight bookings is the biggest indicator of what’s happening in the travel market today. Flights are a key indicator because historically, travel insurance was purchased more often when a flight was involved.

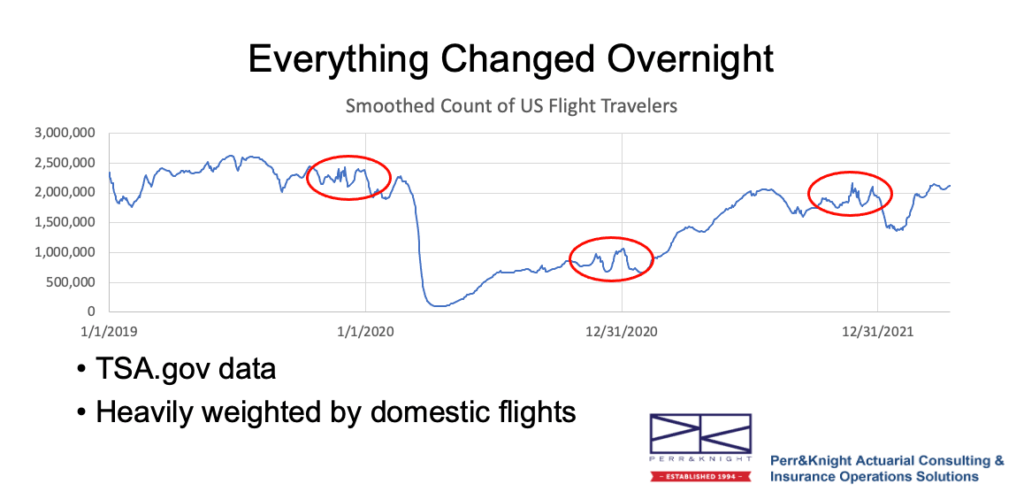

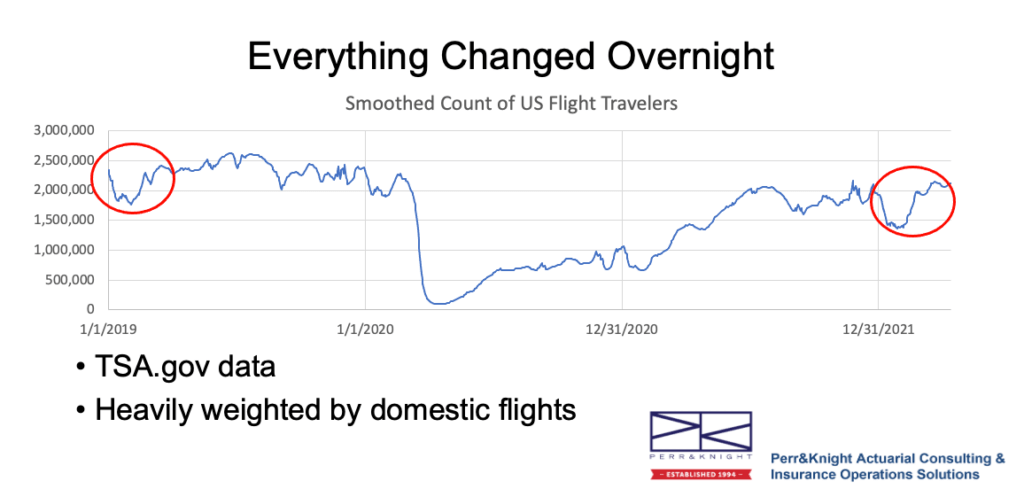

In 2019, we saw 2.5 million travelers a day pass through TSA. The initial landfall of Covid-19 in March 2020 threw the market into near-instant havoc, experiencing a sharp decline seemingly overnight. Since then, the travel industry has shown great strides in rebounding.

What’s important about today’s counts is the behavior or seasonality characteristics noted at the end of the year (“holiday season”) that mimic pre-pandemic travel, except at a lower level. However, Americans’ appetite for travel is gaining momentum quickly, resulting in numbers that are nearly back to 2019 levels in two short years.

We are also seeing similar travel behavior from 2019 mimicked in the first four months of 2022—further proof that the market has a strong foothold on the path back to “normalcy.”

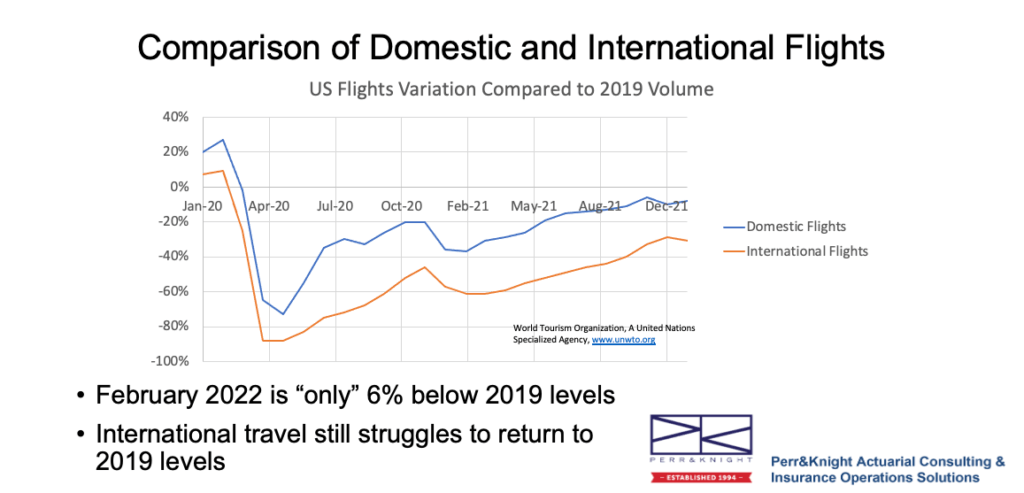

Flights and cruises are on the rebound

Beginning in 2020, the largest dip in travel behavior was due to the onset of Covid-19 first reaching the United States. Since that initial bottoming out, the market has made increasing trends upward. Domestic travel has started to gain momentum and is increasing at a rapid pace. As of March 2022, U.S. travel is only roughly 5% below 2019 levels, which is heavily weighted toward domestic travel. International travel experienced a more sluggish rebound in 2020 but is strengthening at nearly the same rate as domestic travel in 2021.

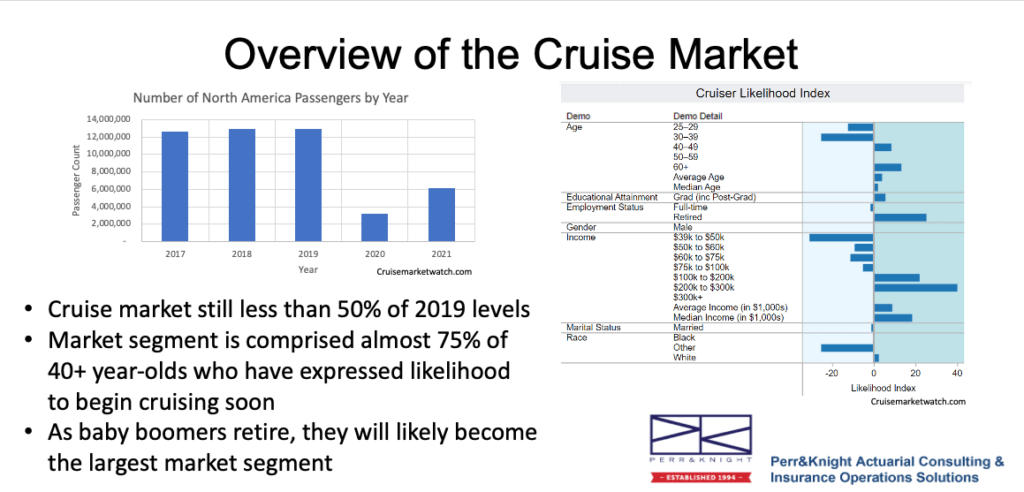

The cruising market took a near-instant nosedive once the outbreak of Covid-19 reached the United States. Today, cruising travel is still less than 50% of 2019 levels. During 2021, the cruising market has shown gradual (but slow) growth. Younger travelers are wary of the potential for virus transmission in enclosed spaces and are therefore not eager to board a ship anytime soon. However, older travelers appear to have a high likelihood to start cruising again soon. This is especially good news since the last of the baby boomers are reaching retirement age, meaning they have ample time and money for travel.

More travelers are hitting the road

Increased road travel is altering insurance product development to accommodate travelers’ changing needs. Travel by car and RV is having its day in the sun. According to the U.S. Travel Association, RV or car trips jumped in popularity in 2020 and 2021— a trend that appears to be continuing in 2022. Great news for the industry: 85% of Americans are expecting to travel this summer. Roughly 80% plan to travel in their personal or rental vehicles and 46% plan to fly.

Today’s travel insurance product offerings have been modified to focus on needs specific to road travelers, including medical coverage and rental car collision, as opposed to air travel-centric products like trip cancellation/interruption, missed flights, or lost baggage.

That said, 59% of American travelers believe travel prices are too high right now which has prevented them from traveling in the past month. The travel price index is 16% higher than 2019 levels, mostly due to rising fuel costs. However, this statistic does not indicate declines in future outlooks.

From pandemic to endemic: how coverage is changing

Many carriers considered pandemics like Covid-19 to be foreseeable events, so travel products have historically excluded events such as pandemics and epidemics. As a result, there was immense confusion among policyholders and insurance companies regarding specific coverages and exclusions for insureds who purchased travel insurance both before and after the initial outbreak of the virus.

That said, carriers continued to cover trip cancellation and trip interruption as well as medical expenses and emergency evacuation if an insured became ill, even due to the coronavirus.

As the virus moves from pandemic (actively spreading across borders) to endemic (a constant presence), insurance carriers are adjusting their insurance product development to reflect the “new normal” in the travel industry.

CFAR/IFAR

Policies generally do not cover cancellations or interruptions based on fear of contracting the virus, which is why “cancel for any reason” (CFAR) became such a hot topic. CFAR or IFAR (interruption for any reason) covers the cancellation or interruption of a trip under any circumstance. Even if the insured simply doesn’t feel like going on the trip anymore. Insureds who purchased this “any reason” benefit are covered and could recoup at least a portion of their trip. These benefits have since become a very sought-after benefit by insureds seeking peace of mind, which is especially relevant in case a new Covid-19 variant is detected.

Carriers are also reassessing pandemic and epidemic exclusions, opting to include them as covered perils in their policies. This is especially important as insureds start to take a closer look at their policies to determine what is covered and what isn’t.

Government-issued travel advisories

One of the coverages also being called into question today is trip cancellation or interruption due to government restrictions based on the U.S Department of State travel advisories. While cancellation or interruption may not cover the pandemic in general, cancellation or interruption because of government restrictions or travel advisories of level 4 (“Do not travel”) that could potentially include Covid-19 or various other reasons may be covered if the policy includes government restrictions as a listed peril in the policy. This may also include the CDC travel risk assessment of level 3 (“high risk”) which was recently revised and unveiled. Otherwise, government restrictions would not be covered. However, CFAR or IFAR would cover these scenarios.

Increased interest in travel insurance

Fortunately, the United States is essentially “back to normal” for domestic travel within the 50 states with no mandatory pre-arrival testing or quarantines. The federal mask mandate on commercial transit has also been discontinued. Vaccine and mask mandates are now based on state and city ordinances. The number of countries without travel restrictions also continues to climb as 2022 rolls on, which means the government restriction peril may no longer be as valuable as it once was.

A survey from the Automobile Club of America (AAA) found that one-third of U.S. travelers said they are more likely to buy travel insurance for their trips through the end of 2022, specifically because of the pandemic. 69% of travelers said, “the ability to cancel a trip and get a refund” is most important to them when considering travel insurance for an upcoming trip.

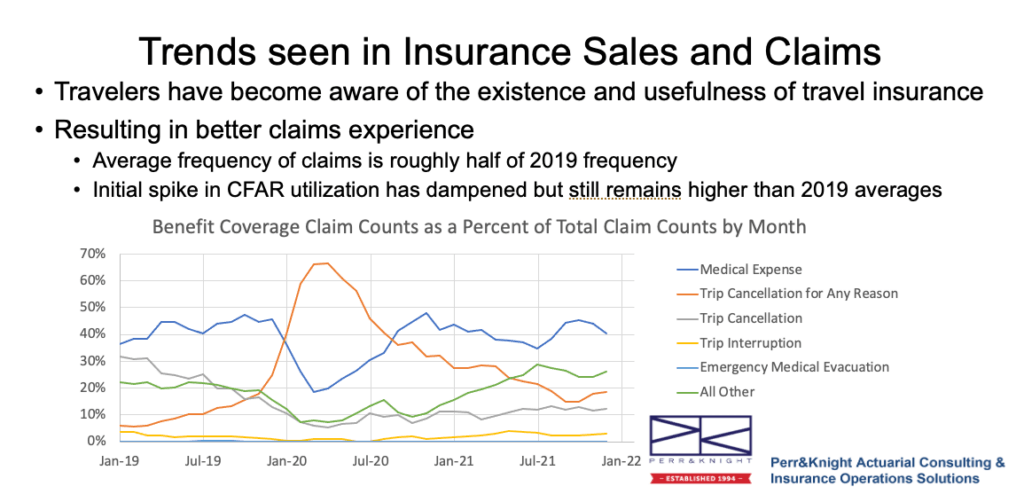

As more people become aware of the existence and usefulness of travel insurance, sales have seen a 10% to 20% jump over 2019 numbers with spikes as high as 53% increase over 2019 following news of the Omicron breakout. This increase in sales has resulted in a better claims experience than previously seen since anti-selection is being hedged against broader market sales.

The average frequency of 2021 claims based on internal data was less than half that in 2019. As a percent of total claims, the initial spike of CFAR claims has dampened but continues to be a highly utilized claim which we expect to continue into 2022, given consumers’ new knowledge about its value.

A new landscape

Covid-19 is here to stay. The initial fear of the virus is winding down, but the industry will continue to see spikes and dips as each new variant emerges. Travelers and insurers must learn to live with this new landscape and respond accordingly. Insurance companies must embrace this new landscape and take these shifts into account during their product development.

Another big takeaway for travel insurers is their ability to monitor claims. Claims submitted under CFAR should be categorized to determine those that are really for Covid-19 but may be disguised as something else. Tracking Covid-specific claims will help do just that. Likewise, more insurers have options specific to pandemic coverage and are providing coverage as its own benefit (trip cancellation, trip interruption, medical expense, and evacuations).

As consumers begin to feel more confident in their return to travel, the goal is to provide equal comfort in their protections through travel insurance.