In our prior blog on Program Business, called “Guidelines for Filing Program Business,” we discussed how insurance carriers have become more and more interested in writing “program” business over the years. In this new blog, we provide guidance on how program administrators can maintain profitability and competitiveness of their programs. As a recap, we will reiterate the definition of program business.

WHAT IS PROGRAM BUSINESS?

According to the Target Markets Program Administrators Association, Program Business is defined as insurance products targeted to a niche market or class, generally representing a book of similar risks placed with one carrier. The administration of the program is done through Program Specialists, often referred to as Program Administrators or managing general agents (“MGAs”), who have developed expertise in that market or class.

Although administrative responsibilities are negotiated between the Program Specialist and Carrier, the responsibilities of the Program Specialist include underwriting selection, binding, issuing, billing, and often marketing, premium collections, data gathering, and claims management / loss control.

PROFITABILITY ANALYSES

Maintaining profitability can be difficult without a thorough understanding of the actuarial figures insurance carriers and reinsurers generally look at when reviewing Program Business. We discuss below a few types of standard actuarial analyses that are very beneficial to supporting a discussion around profitability.

Overall Rate Level Indications

A rate indication estimates the rate change necessary on an aggregate basis to balance the fundamental insurance equation, i.e., Premium = Losses + Loss Adjustment Expenses + Underwriting Expenses + Underwriting Profit, in the prospective / future period.

For admitted and non-admitted programs, this indication will provide actuarial support for any desired base rate changes, whether positive or negative, and indicates the change needed to meet the program administrator’s desired profit provision.

For example, if your projected loss ratio is 55.0%, this would be compared to the target (or permissible) loss ratio of say 65.0%. The division of these two results in a factor of 0.846 (rounded to three decimal places). By taking 0.846 minus 1.000 you get an overall indication of -15.4%. This implies rates could be decreased by 15.4% while still achieving the desired profit provision.

Historical and Projected Loss Ratio Analysis

While very similar to the Overall Rate Level Indications, these have more of a focus on the historical ultimate loss and defense and cost containment expense (“DCCE”) ratio and the projection of that ultimate loss and DCCE to the prospective / future policy period as compared to determining the amount rates many need to increase or decrease.

The historical ultimates are used to produce loss ratios from more of a financial standpoint and how the program has performed up to the evaluation date of the analysis (for example, an analysis with data as of December 31, 20XX.) The projected ultimate loss and DCCE ratio (i.e. also called “the loss pick” by many program administrators) gives the program administrator an expectation of how the program might perform, from a loss ratio standpoint, over the next policy year all else being equal.

Rating Factor / Class Plan Analyses

A rating factor or class plan analysis will review all rating variables in a rating manual. Rating factors, for example, might include territory (or zip code), limit of insurance, deductible, class code, age of building, credit score, etc.

There are two main types of class plan analyses: one-way analyses and multi-variate analyses. One-way analyses review each rating variable on a standalone basis while not considering any correlation with other rating variables. Multi-variate analyses, which typically involve modeling, such as generalized linear modeling, or other techniques, help to remove correlation between rating variables. Multi-variate analyses typically require much more data, time, and effort.

Program managers will want to determine which analysis makes the most sense for their specific book of business. These types of analysis are very helpful in determining which rating factors are profitable and unprofitable and what changes should be implemented to maintain or improve profitability.

COMPETITIVE ANALYSES

In conjunction with profitability analysis, reviewing the rates, rating plans, forms and endorsements of your competitors are key to help maintaining profitability. It is important that a rating plan achieves an appropriate rate for the risk.

If your competitors have more advanced rating plans or different rating variables that achieve a better rate for the risk, you will likely be adversely selected against and lose your profitable business to a plan with lower rates for these good risks. Conversely, the unprofitable business will stay with you since you are unable to charge them the higher rates needed to achieve profitability.

Finally, there are many differences in policy forms and endorsements that could cause you to pay claims your competitors would otherwise exclude and enhancement endorsements making your competitor’s program more attractive.

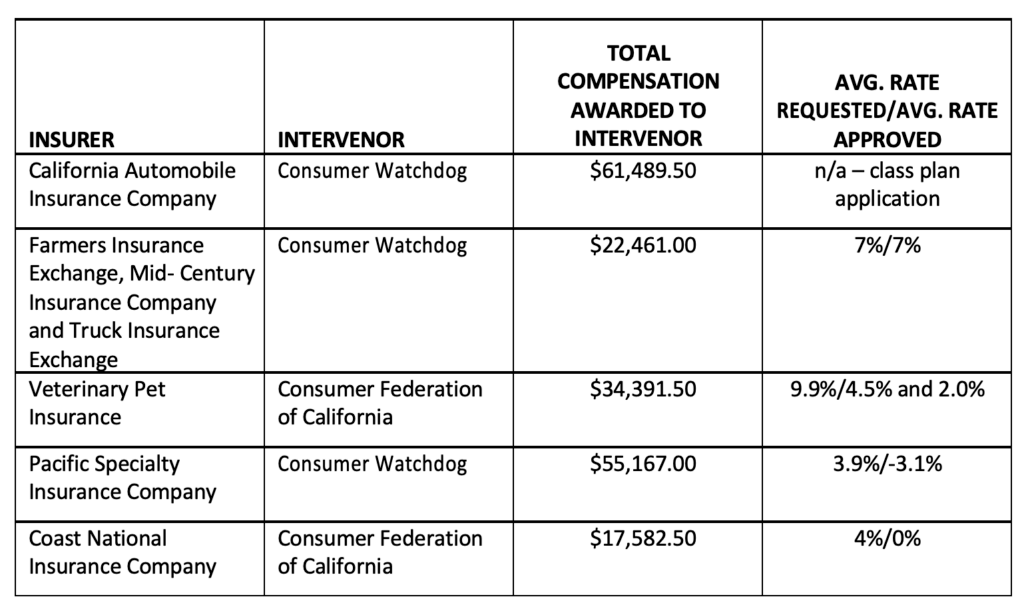

The majority of competitor information used in these comparisons comes from publicly available filings or company / industry financial information. We discuss three types of competitor analyses below.

Competitive Analyses – Rates: Along with the above-noted actuarial analyses, it is beneficial to analyze your competitive position at the same time to help ensure any changes made based on your data do not adversely impact your competitive position.

Premium comparisons compare your policy premium, for a specific number of rating examples, to that of your main competitors. Rating factor / class plan comparisons are similar to premium comparisons, except they compare all the underlying factors by rating variable in your rating manual to your competitor’s rating factors. While performing this review, you can also determine if your competitors are offering different or more competitive coverages and/or different rating variables not currently a part of your rating plan, that achieve a better rate for the risk, and might be worth implementing.

Competitive Analyses – Forms: In conjunction with the premium and rating variables analysis above, it is important to review your policy form and endorsements to help ensure you are offering (and excluding) similar coverages.

If not, you may want to make changes – or at least acknowledge the differences are intentional – and ensure that the rates appropriately reflect the differences. When reviewing endorsements, the entire forms library is usually compiled to see if any key exclusionary or broadening endorsements are missing that might assist in profitability as well as competitiveness.

In addition, if it has been quite some time since a state-by-state compliance review has been performed, our product design team could uncover non-compliant forms or endorsements. Making appropriate adjustments ahead of time will prevent painful market conduct exams in the future.

Market Research – It is also good to monitor new programs or filing revisions your competitors are implementing. If you are aware of when your competitors are increasing rates, adding new rating variables, changing coverages, adding new forms etc., you can make changes accordingly to maintain your competitive position.

Do you need guidance from a profitability or competitive standpoint on your program or a specific book of business? The actuarial consulting, product design and state filings experts at Perr&Knight are here to help. Contact us today.