With foreign body ingestion, poisoning, and cancer, along with being hit by car, ligament ruptures, and other accidents and illnesses, pet owners need to be prepared for the large unexpected veterinary bills that occur in treating their pet for these events. Pets are considered family members by many of us and require a significant amount of healthcare over the pet’s life, especially as the pet gets older and illnesses are more likely. In recent years, pet health insurance has been gaining in popularity and provides a way for pet owners to better manage the healthcare expenses of their pets.

For providers of pet health insurance, there are a number of ways to help enhance the likelihood of being profitable in the pet health insurance space while providing a valuable product to the pet owner.

Here are the key items that should be at the top of the list for successful programs:

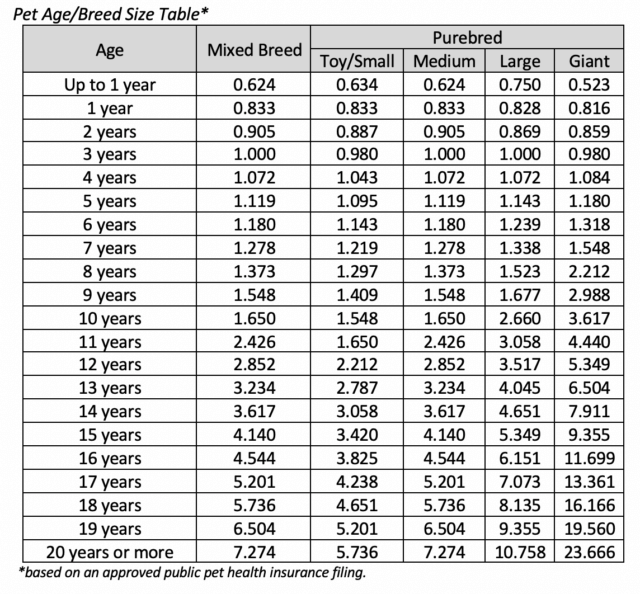

- Consider the impact and correlation between pet age / breed / size: While most pet health insurance writers want to focus on very young pets that will on average have better claims experience, the average age of the book of business will eventually increase as the company renews policies and the renewal of these aging pets will eventually outweigh the newer younger pets. Pet age factors are key in helping to achieve a better rate for the risk, but the risk associated with pet age is highly correlated with breed and size of dog. The table below shows an example of how pet health insurance writers are helping to maximize the correlation between these rating variables.

- Don’t rely on age at inception alone: Age at inception is a concept similar to whole life insurance, where your premiums do not increase as your age increases. While this may work for life insurance, it generally results in inadequate rates for pet health insurance as the average age of the book increases. Without another rating variable to compensate for the lost premium as the pet ages, the use of age at inception becomes more problematic as time goes on.

- Include automatic trend adjustments: Since the annual frequency and severity trend in pet claims is significant (typically ranging from 8% to 15%), a number of Departments of Insurance (“DOIs”) permit a rating factor that includes automatic trend adjustments. This allows premiums to increase over time without filing a rate increase with the state DOI. It is best to take advantage of this rating factor as it can significantly help with maintaining the profitability of the program in the states where this is allowed.

Following are a couple of examples of approved automatic trend adjustments:

- Example 1: Due to this being health insurance for dogs and cats, loss costs will be susceptible to veterinary medical trends which we estimate to be compounding at a rate of up to 9% per year. A trend factor of up to (1+0.09)^(x/12), where x is the number of months since the effective date of this filing, may be applied to this base loss cost to account for the aforementioned inflationary effects.”

- Example 2: This factor is based on an expected annualized trend of 10.0% to account for the increasing cost of veterinary medical care. The formula for calculating the factor is (1+0.10)^(m/12) where m = the number of months since the base rate went into effect, and the factor in the first month of the proposed effective period equals 1.000 (i.e. m=0).

- Take advantage of ranges and flexibilities: Because pet health insurance is a property and casualty product and typically is filed under personal inland marine (only a handful of states are different), the DOIs in many states allow an insurance company to file subjective and experience-based rating variables for group policies, such as ranges of debits of credits, a schedule rating plan and/or an experience rating plan. It is best practice to add these where permitted to enhance rating flexibility.

- Don’t forget about forms: It is important to ensure your policy form has standard waiting periods and exclusions for pre-existing conditions, etc. to make sure you are not covering unexpected past injuries or illnesses.

- Keep in mind that there are difficult states when it comes to profitability: Unfortunately, the biggest pet health insurance states when it comes to premium volume are also the most difficult ones to make money, such as California, Florida, New York, and Washington. These four states can sometimes make up to 50% of a nationwide book of business and the necessary rate changes to maintain profitability are often difficult to obtain with long approval timelines. While it may be enticing to write in these states due to the high growth potential, be careful as it is rare to be profitable in these states and very difficult to non-renew the business if things go south.

- Don’t set and forget: Pet health insurance rates need to be managed over time. A key to maintaining profitability is to take the necessary rate changes to at least achieve the target loss and expense ratio. Too often companies wait a few years before reviewing rates. This makes it very difficult to realize the rate level needed to achieve and maintain profitability.

- Monitor, monitor, monitor: It is important to not only understand the profitability of your book of business from an overall standpoint, but also whether your class plan rating variables are appropriately pricing the risk. Whether rating variables (such as state, deductible, coinsurance, pet age, breed, et.) are reviewed individually or with the use of predictive modeling, these analyses should be performed at least once a year to understand where the program is profitable and where rate increases are necessary to improve or maintain that profitability.

Pet health insurance is a fast-growing market with significant growth potential, but there are also a lot of ways to lose money in the process and companies can get themselves into a hole that is sometimes very difficult to dig out of.

About Perr&Knight

Perr&Knight is a leading provider of both actuarial consulting and pet insurance product development services to companies providing pet health insurance. Our consultants have assisted a number of pet health insurers with developing and maintaining a profitable pet health insurance product.