Set to take effect on July 1, 2021, Senate Bill 55 will allow a waiver on some requirements for regulated access to South Dakota’s insurance market to allow insurers to test innovative insurance products or services.

The changes are primarily for property & casualty. Currently, the Department is not granting waivers for life insurance, health insurance, workers’ compensation insurance, or title insurance. The full list can be found in Senate Bill 55.

To participate in this market, interested parties need to submit an application to the Director of Insurance with information specific to the testing and provide the information detailed in the bill. A $2000 non-refundable fee applies to the application but, at the discretion of the director, may be reduced or removed if the applicant holds a license.

The term “innovation” and other key phrases are defined in the Senate Bill to avoid any vagueness.

Other states with similar enactments include Utah, with its “regulatory sandbox” program, which also allows for certain laws or regulations to be waived, and Arizona. Arizona’s House Bill 2277 is similar to South Dakota’s but is specific to the health care market and caters to individual and small group markets.

The concept of the sandbox is to allow new and small businesses the opportunity to test new and innovative ideas without all the heavily enforced regulation.

As we are seeing more states allow for modern initiatives such as the innovation waiver and regulatory sandbox, this is a pretty clear indication that this is a step in the right direction for the future of the insurance world. This provides some relief for start-ups and small businesses that took a hit during the pandemic by allowing trial and error to test insurance products or services without as much regulatory restraint.

Interested in finding out more about our services? Please contact Perr & Knight for guidance and assistance on all your insurance needs including but not limited to state filing submissions and actuarial services.

Actuarial Consulting

California Approves Vehicle History Rating for Personal Auto

Companies now have a new tool to more accurately price personal auto insurance in California. The TransUnion Vehicle History Score powered by CARFAX® was approved by the California Department of Insurance (“CDI”) in a personal auto filing for Acceptance Insurance. This is exciting news for those of us that develop pricing for personal auto insurance in California. The filing, which was prepared and supported by Perr&Knight’s actuarial consultants, was approved in February of this year.

Due to California regulations, which limit the rating variables that can be used in pricing personal auto insurance, it’s not often that new methods for risk differentiation are allowed in California. Actually, innovation in pricing personal auto insurance does not happen in California, because new rating variables are, for the most part, not allowed under the regulations. So why did the CDI approve Vehicle History as a rating variable? Well, it is not technically a new rating variable. The regulations allow companies to use vehicle characteristics in pricing personal auto insurance in California. This includes vehicle make, model and model year along with other vehicle characteristics, such as automatic braking and lane departure warnings – all of which insurance companies currently consider when rating personal auto insurance in California. CARFAX’s Vehicle History data adds another layer of information about the vehicle. The traditional rating for vehicle characteristics treats all the vehicles from an auto manufacturer with the identical features (including make, model and model year) the same and does not reflect the actual condition of an individual vehicle. Once the vehicle leaves the car dealer’s lot, there are numerous factors that will have a bearing on the condition of the vehicle over its lifetime, and these factors will impact the damageability, safety and performance of the vehicle. By adding Vehicle History Score, based on the vehicle’s historical footprint, to the rating plan, insurers are able to offer more competitive rates, while managing their risk.

The Acceptance filing included information, which is publicly available, on the performance of the TransUnion Vehicle History Score. Below is a chart displaying this information. It includes the pure premium[1] relativities for the validation sample, which have been adjusted for correlations with other rating variables used in California. The chart displays the pure premium relativities in 10 groups of approximately the same size with the best performing group having a relativity of 0.60 and the worst performing group having a relativity of 1.30.

The above chart demonstrates a strong correlation between the pure premium relativity and the Vehicle History Score.

Insurers are often looking for ways to improve the accuracy of their personal auto rating plans. The TransUnion Vehicle History Score will move insurers in this direction by including more information on the characteristics of an insured’s vehicle. We expect other companies will soon be filing to adopt the TransUnion model for their personal auto program in California. We look forward to helping insurers with these filings.

About Perr&Knight

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our actuarial consultants actively follow the California market and are very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company. Our experience includes expert testimony on rating filings and providing guidance to industry associations.

Contact us today for assistance with your California insurance products.

[1] Pure Premium = Capped Loss / Adjusted Exposures.

Large Risk Rating Options for Workers’ Compensation: What You Should Know

The market for workers’ compensation insurance has undergone a shift as large employers with more bargaining power recognize they can achieve a better financial position by obtaining coverage that more closely aligns the total cost with their unique risk factors. State Departments of Insurance (DOI) have approved a number of sophisticated loss-sensitive options for workers’ compensation insurance, further prompting insurance companies to develop programs like these in order to remain competitive.

Below we have provided an overview of large risk rating workers’ compensation products and how Perr&Knight can help you develop competitive plans with the best chance of approval.

Large Deductible Plans

Large deductible workers’ compensation plans provide the same coverage as guaranteed or fixed cost plans, but with higher deductibles, possibly leading to reduced costs for insureds. Deductibles for these plans generally start at $25,000 to $100,000 per occurrence and are ideal for large employers seeking to self-insure a portion of their workers’ compensation losses.

Given the insurer is typically required to pay claims as they occur and seek reimbursement from the policyholder for claims below the deductible amount, insurers will often require the insured to provide collateral to secure the claims in this layer. Some jurisdictions may require insurance carriers to hold collateral, and insurers often need to analyze each risk individually to determine the amount of collateral to collect. This is an instance where turning to experienced actuarial consultants is invaluable. Our expert teams can assist in determining how much collateral to hold, either by performing actuarial loss projections based on historical loss runs prior to the onset of the policy or performing a collateral evaluation over time to ascertain how losses and collateral needs have developed for a particular policyholder.

Our actuarial consultants can help you develop your large deductible program, provide guidance on the various premium threshold requirements and permissible deductible levels by jurisdiction, as well as meet other state-specific requirements when filing large deductible workers’ compensation programs.

Retrospective Rating Programs

Retrospective (also called “retro”) rating plans determine the final workers’ compensation premium by evaluating actual losses incurred during the policy period. Employers pay a certain premium upfront, but at set intervals after the policy expires, insurance companies evaluate actual losses versus what was originally expected. This can result in a premium refund to the insured if losses are better than expected and additional premium due if losses are worse than expected. These sophisticated plans can be helpful in controlling the final cost of an organization’s workers’ compensation program.

Because of their complexity, it is imperative to set retro programs up correctly from the outset. Perr&Knight’s actuarial consultants can assist in determining proper rating factors (expected loss ratios, the types of excess factors to file, other rating elements to file in various states, etc.), as well as determining if the state DOI will allow exceptions to bureau filed plans.

Large-Risk Alternative Rating Option (LRARO)

A provision commonly contained in retrospective rating plans, LRARO can be layered on top of other programs, enabling employers with a yearly estimated workers’ compensation premium exceeding a certain threshold to negotiate premiums with their insurance provider. With this rule on file, insurers can negotiate the rating factors and premium components involved in determining the final premium for their workers’ compensation coverage.

This option is permitted in most states, but filing requirements vary by jurisdiction. For example, some states have premium eligibility requirements which must be met before the insurance company may use this rating option.

We have deep experience in developing loss sensitive rating programs and filing LRARO rules to achieve exceptional rating flexibility. Our actuarial consultants understand important jurisdictional filing differences and can help you file this provision correctly.

Partner with Actuarial Experts

Sophisticated large risk rating programs add more complexity to an already complicated process. Our actuarial teams are profoundly experienced in the full scope of loss sensitive programs and can help with designing large risk workers’ compensation products including developing rating plans, defining rules, helping with endorsements, and ultimately managing state filings.

For insurance companies already offering loss sensitive workers’ compensation products, we can conduct reviews to determine if it is possible to enhance your product offerings, or conduct detailed competitive evaluations to make sure your program is in line with the market.

Thinking of making changes to your workers’ compensation products? Our expert actuarial consultants can help.

Pet Health Insurance: Eight Key Ways to Enhance Profitability

With foreign body ingestion, poisoning, and cancer, along with being hit by car, ligament ruptures, and other accidents and illnesses, pet owners need to be prepared for the large unexpected veterinary bills that occur in treating their pet for these events. Pets are considered family members by many of us and require a significant amount of healthcare over the pet’s life, especially as the pet gets older and illnesses are more likely. In recent years, pet health insurance has been gaining in popularity and provides a way for pet owners to better manage the healthcare expenses of their pets.

For providers of pet health insurance, there are a number of ways to help enhance the likelihood of being profitable in the pet health insurance space while providing a valuable product to the pet owner.

Here are the key items that should be at the top of the list for successful programs:

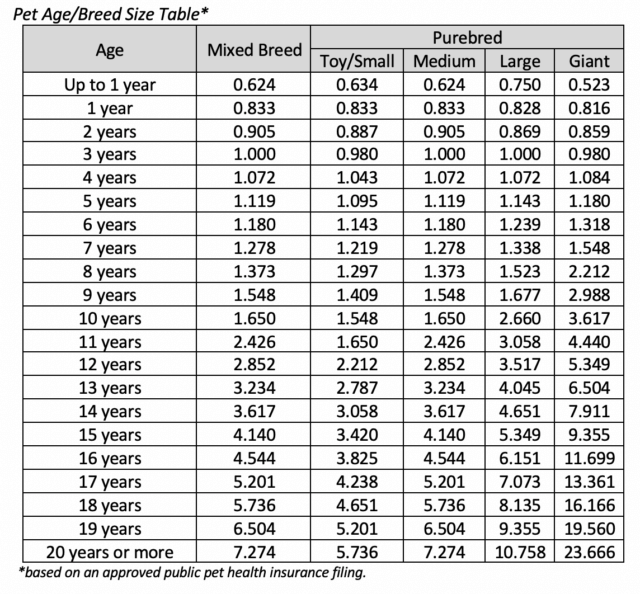

- Consider the impact and correlation between pet age / breed / size: While most pet health insurance writers want to focus on very young pets that will on average have better claims experience, the average age of the book of business will eventually increase as the company renews policies and the renewal of these aging pets will eventually outweigh the newer younger pets. Pet age factors are key in helping to achieve a better rate for the risk, but the risk associated with pet age is highly correlated with breed and size of dog. The table below shows an example of how pet health insurance writers are helping to maximize the correlation between these rating variables.

- Don’t rely on age at inception alone: Age at inception is a concept similar to whole life insurance, where your premiums do not increase as your age increases. While this may work for life insurance, it generally results in inadequate rates for pet health insurance as the average age of the book increases. Without another rating variable to compensate for the lost premium as the pet ages, the use of age at inception becomes more problematic as time goes on.

- Include automatic trend adjustments: Since the annual frequency and severity trend in pet claims is significant (typically ranging from 8% to 15%), a number of Departments of Insurance (“DOIs”) permit a rating factor that includes automatic trend adjustments. This allows premiums to increase over time without filing a rate increase with the state DOI. It is best to take advantage of this rating factor as it can significantly help with maintaining the profitability of the program in the states where this is allowed.

Following are a couple of examples of approved automatic trend adjustments:

- Example 1: Due to this being health insurance for dogs and cats, loss costs will be susceptible to veterinary medical trends which we estimate to be compounding at a rate of up to 9% per year. A trend factor of up to (1+0.09)^(x/12), where x is the number of months since the effective date of this filing, may be applied to this base loss cost to account for the aforementioned inflationary effects.”

- Example 2: This factor is based on an expected annualized trend of 10.0% to account for the increasing cost of veterinary medical care. The formula for calculating the factor is (1+0.10)^(m/12) where m = the number of months since the base rate went into effect, and the factor in the first month of the proposed effective period equals 1.000 (i.e. m=0).

- Take advantage of ranges and flexibilities: Because pet health insurance is a property and casualty product and typically is filed under personal inland marine (only a handful of states are different), the DOIs in many states allow an insurance company to file subjective and experience-based rating variables for group policies, such as ranges of debits of credits, a schedule rating plan and/or an experience rating plan. It is best practice to add these where permitted to enhance rating flexibility.

- Don’t forget about forms: It is important to ensure your policy form has standard waiting periods and exclusions for pre-existing conditions, etc. to make sure you are not covering unexpected past injuries or illnesses.

- Keep in mind that there are difficult states when it comes to profitability: Unfortunately, the biggest pet health insurance states when it comes to premium volume are also the most difficult ones to make money, such as California, Florida, New York, and Washington. These four states can sometimes make up to 50% of a nationwide book of business and the necessary rate changes to maintain profitability are often difficult to obtain with long approval timelines. While it may be enticing to write in these states due to the high growth potential, be careful as it is rare to be profitable in these states and very difficult to non-renew the business if things go south.

- Don’t set and forget: Pet health insurance rates need to be managed over time. A key to maintaining profitability is to take the necessary rate changes to at least achieve the target loss and expense ratio. Too often companies wait a few years before reviewing rates. This makes it very difficult to realize the rate level needed to achieve and maintain profitability.

- Monitor, monitor, monitor: It is important to not only understand the profitability of your book of business from an overall standpoint, but also whether your class plan rating variables are appropriately pricing the risk. Whether rating variables (such as state, deductible, coinsurance, pet age, breed, et.) are reviewed individually or with the use of predictive modeling, these analyses should be performed at least once a year to understand where the program is profitable and where rate increases are necessary to improve or maintain that profitability.

Pet health insurance is a fast-growing market with significant growth potential, but there are also a lot of ways to lose money in the process and companies can get themselves into a hole that is sometimes very difficult to dig out of.

About Perr&Knight

Perr&Knight is a leading provider of both actuarial consulting and pet insurance product development services to companies providing pet health insurance. Our consultants have assisted a number of pet health insurers with developing and maintaining a profitable pet health insurance product.

Please contact us with any assistance that is needed with your pet insurance product development.

Are Rising P&C Insurance Premiums Eroding Your Company’s Profits? Take Control with Self-Insurance

Authors: Charlie Lenz, ACAS, MAAA, Principal & Consulting Actuary, and Les Vernon, FCAS, MAAA, Senior Consulting Actuary

Property and casualty insurance brokers are reporting significant rate increases and reduced capacity, resulting in less favorable coverage terms and often higher deductibles or self-insured retentions being offered. Causes are higher underwriting losses, lower investment returns, and now, the COVID-19 pandemic. This has made finding the coverage a business needs at an affordable price increasingly difficult.

The Commercial Auto Liability line is experiencing increased frequency and severity of claims, producing poor combined ratios. Contributors to the increased frequency of claims are more vehicles on the road and distracted drivers in recent years. A shift to newer vehicles with advanced driving technology has made repairs more expensive.

The General Liability line is experiencing increased severity of claims due to a greater portion of claims being litigated and social inflation, where juries are increasingly calling for greater corporate accountability, and high awards are becoming more acceptable.

The uncertainty surrounding the COVID-19 pandemic and the potential litigation to expand coverage for business interruption retroactively has placed upward pressure on Property rates. In addition, recent hurricane and wildfire activity has forced steep increases in premiums for risks with catastrophe exposure.

Exposure of essential workers to COVID-19 infection combined with mandated coverage expansion in some jurisdictions is threatening to increase costs for workers compensation insurance – one of the few lines of business not yet seeing upward pressure on premium levels. There is also uncertainty regarding potential future litigation of health care providers related to COVID-19, which, in addition to an increased frequency of large claims, is contributing to increased rates in medical professional liability coverage after years of flat rates.

With many more workers shifting to working from home as a result of the COVID-19 pandemic, if only temporarily, businesses are less in control of their computer networks and are more susceptible to phishing and hacking activity. As losses continue to rise, rates are predicted to see double-digit increases.

There are alternatives to suffering through multiple years of increasing insurance premiums and/or coverage reductions. If your organization is experiencing lower claim trends than the industry, self-insurance of some form may be an option worth exploring. Your company can retain more of their own risk via a large deductible policy or participation in a risk retention group. Alternatively, the company can form a captive insurance company (or participate in a group captive) to insure against some exposures for which it currently pays a high premium. Potential advantages are lower costs, insulation from some of the volatility of the insurance cycle and, in the case of a captive insurance company, control over claims administration and direct access to reinsurance markets.

In order to determine if self-insurance is a good option for your organization in this hard market, historical claims experience can be used to perform a retention analysis for a large deductible option and a captive feasibility study for a captive option.

Perr&Knight has a large actuarial consulting team for self-insurance. If your company is looking to reduce your insurance costs and is considering self-insurance, contact us. Our actuaries will use their expertise to help you evaluate the different options available.

The Race to Autonomous Vehicles

The $2 trillion global automotive industry is ripe for disruption from autonomous vehicle technologies that make driving safer, more energy-efficient and more convenient. Driver error causes more than 9 out of 10 crashes. Autonomous vehicles are robots on wheels that eliminate driver perception, distraction and incapacitation errors. While cybersecurity risk poses a safety threat, there is little doubt that robots can drive better than humans under normal conditions. Most autonomous vehicles are powered by eco-friendly, zero-emission electric batteries, and they are designed to drive safely and efficiently. Autonomous vehicles offer limitless opportunities for convenience by changing the driver into a passenger.

Following several years of product and strategy improvements along with making progress in gaining regulatory approvals for road testing, the major players are emerging in the race to commercialize fully autonomous vehicles. To name a few, Waymo started as Google’s self-driving car project and is a self-driving taxi service currently operating in Phoenix, Arizona with a pilot program for employees in California. Waymo is the largest active self-driving company in terms of daily miles driven. General Motors’ Cruise provides an autonomous ride-hailing service for its employees in San Francisco and recently unveiled plans for its fully autonomous Origin with no steering wheel or pedals. Volkswagen and Ford have made large investments in self-driving software company Argo AI with plans to implement Argo AI’s software in new vehicles in the early 2020s. Uber is heavily investing in replacing its human fleet with a driverless fleet. Startups like Optimus Ride and Pony.ai have launched self-driving ride-hailing services in designated areas of cities like Brooklyn’s Navy Yard.

These companies have really smart people, breakthrough technologies and deepening pockets. And they are all watching Tesla whiz by in the race to commercialize autonomous vehicles.

Here are several reasons why.

ADVANCED TECHNOLOGY WITH NO BOUNDARIES

Tesla’s autonomous vehicle system primarily uses cameras to identify stationary and moving objects in the vehicle’s surroundings. Radar and other sensors are used to help see in dark and adverse weather conditions. The Autopilot system is a standard feature and currently qualifies Teslas for SAE Level 2 Automation, which means it can handle all aspects of driving under certain conditions, but the driver must be ready to intervene at all times. Tesla deploys the hardware needed for self-driving in all of its vehicles sold to consumers, and they use the hardware to train artificial intelligence systems called neural networks that are designed to automatically improve with new data.

Virtually all major players except Tesla are using LiDAR technology to build autonomous vehicles. LiDAR is a sensor system that measures reflections from laser pulses to build a 3D representation of the environment around the vehicle. Geofencing is used to define spatial boundaries, and detailed maps of the terrain and objects within the geofence are developed. The self-driving car projects the sensor data on top of the map to gather information and determine the safest path.

Proponents of LiDAR argue the technology is crucial to reliably assess and measure the environment around the car in all conditions. Argo AI describes a “street-by-street, block-by-block” mindset[1] underlying their LiDAR-based technologies to make self-driving vehicles safe and accepted by society. The goal of this approach is SAE Level 4 Automation, which does not require any human intervention in limited spatial areas.

Elon Musk, Tesla’s founder and CEO, criticized the use of LiDAR in autonomous vehicles at Tesla’s 2019 Autonomy Day event. “In cars, it’s freaking stupid. It’s expensive and unnecessary…once you solve vision, it’s worthless. So you have expensive hardware that is worthless on the car.”[2] He has a point. Although the per unit cost of LiDAR is dropping, it still costs a few thousand dollars per vehicle. Researchers at Cornell University found that cameras can detect objects with near the precision of LiDAR at a fraction of the cost[3]. Also, developing capacity for LiDAR use by geofencing and mapping communities is costly and slow whereas camera-based systems can be employed in cars anywhere in the world. Musk’s goal for Tesla is SAE Level 5 Automation, which does not require any human intervention with no spatial limitations.

TESLA HAS THE DATA

Training a self-driving car requires a lot of data. Tesla has over 3.3 billion Autopilot miles and 22.5 billion miles in Tesla vehicles[4] from its fleet approaching 1 million units sold worldwide. On an average day, Tesla collects approximately 650x more driving data than Waymo.[5] Tesla feeds the vast amount of data it is collecting into its advanced neural networks, which use the data to improve the vehicle’s ability to predict common behaviors as well as behaviors for rare situations that are difficult to simulate. Although Autopilot is currently intended only for use on highways, Tesla is using the data it gathers in all environments to train its cars how to handle intersections, traffic lights and pedestrians.

VERTICAL INTEGRATION FOSTERS INNOVATION

Many autonomous vehicle companies are partnering with automotive companies to implement their self-driving platform into new vehicles. Waymo has equipped several types of cars with its self-driving equipment. Argo AI partnered with Ford and Volkswagen to roll out its autonomous vehicle technology in both the U.S. and Europe. Daimler has partnered with Baidu to equip Baidu’s Apollo program, an open-source autonomous vehicle platform, onto Daimler’s Mercedes-Benz vehicles to test self-driving vehicles in Beijing, China.

Tesla is an automotive company and an autonomous vehicle company, allowing the company to fully integrate hardware and software autonomous vehicle specifications into its vehicle design and build processes. Large automobile companies typically source their parts from suppliers all over the world who can meet their quality demands at the lowest cost. Tesla learned the dangers of a global supply chain the hard way when its Model X deliveries fell far short of demand in early 2016 caused by a shortage of parts from a supplier. Tesla has moved many parts manufacturing operations in-house, which has led to new types of batteries, seats, motors, windows and other parts that differentiate Tesla from the competition. Bringing parts manufacturing in-house allows Tesla to be flexible and nimble in pushing improvements into its products. Musk noted Tesla pushed 20+ improvements per week into the product development process of Model S[6]. Tesla’s culture of continuous improvement is key for automation where iterative development is required to make driverless cars safe.

SELF-DRIVING TESLAS ARE STILL PERSONAL AUTOMOBILES

Most autonomous vehicle companies are intending to provide ride-hailing services. These companies are making big bets on the future of shared vehicles, but they don’t have much choice. Consumers do not want to buy a personal automobile that doesn’t operate outside of the town’s geofence, and the LiDAR-based system is costly equipment to pass on to the consumer. A vehicle-sharing model makes sense in highly congested urban areas where parking space is limited, but it will not displace personal automobiles anytime soon. Car owners value the accessibility and independence of having their own vehicle. Also, in the new era of social distancing and extra health safety precautions, vehicle sharing and ride sharing faces serious headwinds.

In contrast, when Musk and the regulators determine Tesla’s fully autonomous vehicle technology is safe for use, a simple over-the-air software update can transform Tesla’s automobile fleet into a fleet of driving robots with human-driver capabilities.

In 2019, Musk predicted Tesla’s self-driving vehicle technology will be feature-complete by the end of 2020. While this timeframe seems overly aggressive, I hesitate to doubt Musk. After all, one of Musk’s other companies, SpaceX, just became the first private company to send humans into orbit, and the company is seeking to send humans to Mars and beyond. Compared to space travel, teaching robots to drive safely at 55 miles per hour is a manageable problem.

In reality, there will be room for many winners in the autonomous vehicle market. Global automakers like Volvo, BMW, Nissan and Toyota have stumbled out of the gates in building self-driving vehicles, but they continue to invest and will not be far behind. Ride-hailing startups could shift consumer preferences on car ownership if people are able to order a ride on their phone anytime, anywhere. Autonomous vehicles have the potential to be used for a multitude of purposes including for commercial cargo transportation and in vehicles used for urban commuting or long-distance transit.

The time is now to start planning your insurance needs for the autonomous vehicle age. Contact our product development and product design experts for help.

[1] https://www.argo.ai/2019/09/the-argo-ai-approach-to-deploying-self-driving-technology-street-by-street-block-by-block/

[2] https://www.theverge.com/2019/4/24/18512580/elon-musk-tesla-driverless-cars-lidar-simulation-waymo

[3] https://www.therobotreport.com/researchers-back-teslas-non-lidar-approach-to-self-driving-cars/

[4] https://lexfridman.com/tesla-autopilot-miles-and-vehicles/#:~:text=The%20following%20is%20a%20plot,Tesla%20vehicles%3A%2022.5%20billion%20miles

[5] https://towardsdatascience.com/why-teslas-fleet-miles-matter-for-autonomous-driving-8e48503a462f

[6] https://www.caradvice.com.au/367472/tesla-model-s-gains-20-engineering-changes-per-week/

The Impact of COVID-19 on the Travel Insurance Industry

Authors: Crystal London, FSA, MAAA, Consulting Actuary, and Susan Cornett, FLMI, AIRC, CFE, Manager A&H Product Design

Coronavirus Disease 2019 (COVID-19) has had a dramatic impact on the travel industry – likewise the travel insurance industry – since it first made landfall in the U.S. in January. Travel ground to a near-halt in record time as state and federal governments ordered non-essential businesses to shut down, international borders to be closed, and shelter-in-place measures to be adopted, usually with little advance notice.

According to the TSA, airline travel has decreased by approximately 90% from mid-March to mid-May compared to the same period in 2019. This lack of movement has in turn resulted in a dramatic decrease in the need for travel insurance over the past two months, creating serious consequences for the travel insurance industry.

Lessons from the past

The SARS outbreak of 2002-2004 sheds some light on the role of pandemics in the travel insurance industry. After that event, most carriers updated their policies with exclusions and limitations specifically related to pandemics and epidemics. This has led to some confusion among insureds, as those who purchased travel insurance recently automatically assumed their canceled or interrupted trips would be covered. For many carriers, as of January, COVID-19 has fallen into the category of a “foreseen event” as a result of a pandemic, thereby disqualifying it from coverage applying to trip cancelation or trip interruption. However, an exception to this is if the policy includes Cancel for Any Reason or Interruption for Any Reason. As the benefit name implies, the cancelation or interruption is covered under any circumstance. Therefore, insureds who have purchased this “any reason” benefit are covered and could recoup a least a portion of their trip.

That said, most carriers are still offering trip cancelation/interruption coverage as well as medical expense and emergency evacuation coverage if an insured becomes ill, even if due to coronavirus.

However, if insureds cancel or interrupt their travel due to fear of the pandemic (not illness as a result of the pandemic), this reason may not be covered. Given marketing needs and distribution channels, there is no uniform policy across carriers as to when or why these benefits are not covered. Insureds are receiving multiple answers from multiple sources, further adding to their confusion.

What’s next for the travel insurance industry?

Company business is down significantly right now, with some travel insurance carriers seeing double digit decreases in business. Travel insurance coverage isn’t selling because no one is traveling. On the other hand, this decrease in travel has led to a significant decrease in claims payments, so some balancing is occurring.

Some carriers have responded to the pandemic by offering refunds outside the normal free look period or a change of coverage effective date if insureds postpone or reschedule their trip due to coronavirus. The hope is to keep the business on the books, not cancel outright.

Insurers may also face difficultly obtaining reinsurance for travel, especially for catastrophic events. Reinsurance companies, too, are trying to mitigate their risk. Given the current circumstances, reinsurers might be warier, especially due to recent medical models not anticipating a vaccine for another 12-18 months, or travel restrictions remaining in place until testing is widespread or a vaccine is available.

New state filings considerations

Going forward, we anticipate new regulatory compliance hurdles as a result of COVID-19, but to what extent is not yet clear.

Some states have fast-tracked regulatory measures dictating how carriers must address refunds. New York introduced state bill S8124B in March requiring travel insurance companies to refund premiums for COVID-19 related cancelations, but only in the circumstance that no payable claim has been filed already. Additionally, New York Department of Financial Services issued Insurance Circular Letter No. 4 in March allowing carriers to offer cancel for any reason benefits, which it previously did not allow in the state.

We anticipate additional hurdles and delays in future filings for travel insurance. Not just because many Departments of Insurance are operating with a reduced capacity (many are working from home, too), but because there will likely be added scrutiny on travel policies. We also anticipate questions regarding, and possible objections to, the use of epidemic and pandemic exclusions. We have yet to see the full scope of changes regulators will introduce in the coming weeks and months. The travel insurance industry is still adjusting to changes following the 2017 Market Analysis Working Group, subsequent regulatory settlement agreements, and introduction of model travel laws by both NAIC and NCOIL. Those states that have not yet adopted a version of the model law may take the opportunity to address pandemics and epidemics in the legislation at such time as it is adopted.

Make sure your state filings department or insurance support services partner keeps abreast of each state’s updated regulations and statutes. Pay close attention to the release of applicable new bills and circulars. Continuously monitor updates to make sure you follow the new guidelines produced by state DOIs as this unprecedented event continues to unfold.

Opportunities for the future

The news isn’t all bad. After weeks in quarantine, people are beginning to plan vacations and future travel again. They’ve had plenty of time to brainstorm a dream vacation and government stimulus checks have supplied an infusion of cash. In an attempt to generate revenue, travel suppliers like airlines and cruises are offering deep discounts, enticing people to book now for travel in the future.

For many travelers, trip cancelation insurance has never been top-of-mind – until now. People who have never thought of purchasing travel insurance are seeing the value of coverage and may opt for the added peace of mind when booking.

We are also seeing emerging opportunities for carriers to offer policies reflecting a changing travel landscape. Insurance carriers are reassessing coverage options, some opting to include additional pandemic and epidemic perils within their policy. Conversely, instead of added exclusions or limitations, some carriers are weighing options to offer coverage specifically for COVID-19 related issues.

We anticipate a flurry of new state filings in the coming months as carriers rush to reshape their policies to conform to changing customer demands and updated regulatory requirements that are part of this “new normal.”

Right now, our best advice to mitigate the effects of the pandemic is to remain flexible. Prepare to give up a benefit or “unforeseen reason” clause in favor of keeping your eye on the big picture. As DOIs update regulations to adapt to changing circumstances, carriers, too, will need to remain open-minded and ready to make necessary adjustments as we all write a new future for the travel insurance industry.

Need help navigating the fallout from COVID-19? Our actuarial and product design experts are here to answer your questions and develop a solid plan to move forward.

California Commissioner Orders Premium Refunds in Response to COVID-19

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. The implications of the Bulletin are complex and require consideration of various aspects of an insurer’s business model. Perr&Knight is having discussions with the staff at the CDI regarding their expectations for compliance with the Bulletin. We have extensive experience with rate, rule and form filings in California as we submit more filings to the CDI than any other consulting firm and will be assisting insurers with complying with the CDI requirements to ensure that the appropriate adjustments are made for the change in risk and/or reduction in exposure.

The Bulletin requires action of all companies who write the following lines of business in California:

- Private passenger automobile insurance

- Commercial automobile insurance

- Workers’ compensation insurance

- Commercial multiple peril insurance

- Commercial liability insurance

- Medical malpractice insurance

- Any other line of coverage where the measures of risk have become substantially overstated as a result of the pandemic.

The following is required of each California insurer writing the lines above:

- By June 12, 2020, report the following information to the CDI:

a. An explanation and justification for the amount and duration of any premium refund, and how those measures reflect the actual or expected reduction of exposure to loss.

b. Monthly and overall California-specific totals for the following:

i. Percentage of refund applied,

ii. Aggregate premium prior to, and subject to, application of refund,

iii. Aggregate premium refund,

iv. Average premium before and after refund,

v. Average percentage of refund, applied to each policyholder,

vi. Number of in-force policies, and

vii. Number of policyholders receiving refund.

- By August 11, 2020:

a. Provide each affected policyholder, if applicable, with a notification of the amount of the refund, a check, premium credit, reduction, return of premium, or other appropriate premium adjustment.

b. Provide an explanation of the basis for the adjustment, including a description of the policy period that was the basis of the premium refund and any changes to the classification or exposure basis of the affected policyholder.

c. Offer each insured the opportunity to provide their individual actual or estimated experience. For automobile policies, this includes an invitation to provide updated mileage estimates as appropriate.

Perr&Knight is available to discuss any questions or unique situations with the CDI on your behalf. We can also provide information on what other companies have done, to the extent this information is publicly available in California or other states. Finally, we can prepare and submit your required report to the California DOI.

We expect that other states may issue similar bulletins. If there is anything that Perr&Knight can do to assist your company in California or any other state, please complete our contact form.

Auto Accidents Drop Dramatically with COVID-19 Stay-At-Home Order

Authors: Brett Horoff, ACAS, ASA, MAAA, Director, Consulting Services, Dee Dee Mays, FCAS, MAAA Principal and Chief Actuary, and Denise Farnan, ACAS, MAAA Principal and Consulting Actuary.

To control the spread of COVID-19, many states have issued Stay-At-Home[1] orders for non-essential workers, resulting in a large portion of the workforce working from home and many businesses temporarily closing. Schools have also been forced to close or have moved to online solutions for classes. These changes have brought a significant drop in the number of miles driven by each household and the volume of the traffic on the roads. With fewer miles being driven and a decrease in traffic density, the number of auto accidents has decreased.

According to the Public Policy Institute of California, essential workers are one-third to one-half of the California labor force. The definition of essential workers varies across the state. It includes sectors such as healthcare and public health, emergency services, food and agriculture, energy, water and wastewater treatment, transportation and logistics, communication and technology, government operations, critical manufacturing, hazard materials, financial services, chemicals and defense industries. Outside of these sectors, households are no longer commuting to work. There has also been a significant reduction of personal auto use as this is pretty much limited to driving to the grocery store, pharmacy or to pick up takeout food from restaurants.

The average annual miles driven in the U.S. is 13,476[2] or approximately 260 miles per week. For non-essential workers, this could be down to less than 30 miles per week assuming five trips a week that are six miles round trip. This represents an 88.5% reduction in the weekly miles driven for households with nonessential workers from 260 miles per week to 30 miles per week. For households with essential workers, they will also have a reduction in the miles driven per week; however, the essential worker will still be driving to work. Assuming half the average annual miles driven is commuting to work, then an essential worker is driving 130 miles per week to commute to work plus another 30 miles per week for personal use. With these assumptions, they would be seeing a 38.5% reduction in the miles driven per week from 260 miles per week to 160 miles per week. If half the households have essential workers, the reduction in miles driven is 63.5%, which is just an average of the figures for non-essential and essential workers. This is a very rough estimate with simplified assumptions, but it gives you an idea of the impact that the Stay-At-Home orders are having on miles driven.

The number of auto accidents will be directly related to the number of miles driven, so insurance companies should be seeing a significant drop in the number of auto accidents. With fewer vehicles on the road and a decrease in traffic density, there should be fewer auto accidents. The number of reported auto accidents in Los Angeles is down approximately 25% in March 2020 compared to March 2019 based on adjusted data[3] from the City of Los Angeles. The Safer at Home Order was issued by the City of Los Angeles on March 19, 2020, so the full impact on auto accidents is likely to be more than double.

It is still very early to assess the impact that COVID-19 and the impact that Stay-At-Home orders will have on the number of auto accidents. The definitions of essential workers have been changing over time and the orders could be extended. When the orders are lifted, we may also see a slow return back to the prior driving habits. There are several insurance companies that have already taken action to get the savings from the decrease in auto accidents back to their customers. Allstate has submitted filings this week to state Departments of Insurance for a Shelter-in-Place Payback endorsement that authorizes and facilitates discretionary payments to policyholders. They also had a press release on April 6, 2020 that states their customers will receive more than $600 million as part of this payback. Another insurance company, American Family, announced on the same day that they will return $200 million in premium to their auto customers related to the COVID-19 impact on auto accidents. There also insurance companies with pay-per-mile programs where any savings is automatically passed on to the customer, since the customer pays for each mile driven.

There are a number of filings being made by insurance companies to the state Departments of Insurance to address the impact of COVID-19 on auto accidents. Go Maps has filed to offer personal auto discounts to essential workers and recently unemployed workers in multiple states. Next Insurance has filed to reduce the commercial auto premium for their customers for the month of April in several states. Safe Auto Insurance Company and Elephant Insurance Company have also filed rate reductions related to COVID-19. There are several insurance companies that have filed endorsements lifting the delivery exclusion in personal auto policies during the COVID-19 pandemic in order to provide insurance coverage to the increasing number of people delivering medicine and food.

While several insurance companies are moving fast to pass the savings from a decrease in auto accidents on to their customers, there are consumer groups saying it is not enough. There is much uncertainty right now and the full impact of COVID-19 on auto accident frequency will not be known until the pandemic is over. It is likely that insurance regulators in each state will take a look at the impact of COVID-19 on auto accident frequency and may require the premium savings to be passed on to the consumer.

About Perr&Knight

Perr&Knight is one of the largest providers of State Filing Consulting Services to the insurance industry and is available to help insurance companies with preparing and submitting filings addressing COVID-19’s impact on auto insurance or other lines of business. Our actuaries can help companies estimate the impact of COVID-19 and have assisted companies with preparing and submitting filings related to COVID-19.

Contact us to schedule a consultation.

[1] Also referred to “Shelter in Place” or “Safer at Home” in some municipalities.

[2] Figure is for 2018 and is from the U.S. Department of Transportation Federal Highway Administration.

[3] Data was through March 28, 2020 and was extrapolated to month-end. It was also adjusted for a reporting lag.

A Smarter, More Efficient Way to Manage Adoption Filings

Tracking and managing changes to bureau material has long been a time-draining process for property casualty insurance company staff. When we released Bureau Monitor, a subscription service housed within our StateFilings.com system, our aim was to make our clients aware immediately if there were updates required for their bureau based products. By centralizing loss cost, rule and form circulars for all bureaus and lines of business in a single location and then generating automatic notifications explaining the impact on our clients, the system was able to relieve in-house compliance teams from managing the minutiae of circular tracking. It also provided a crucial first line of defense against compliance violations.

We’ve now taken this process one step further. By combining our useful bureau monitoring service with the filing capabilities built into StateFilings.com, we’re launching our newest service: Bureau Maintenance. It’s a single, automated solution for keeping your state filings current.

How Bureau Maintenance Works

Our team of filing experts monitor the circulars impacting loss costs, rules and forms released by the various rating bureaus, including the Insurance Services Office (“ISO”) and the National Council on Compensation Insurance (“NCCI”). We publish these circulars to Bureau Monitor, which then generates a notification if your company is required to file an update to your product based on your specific adoption profile. Using Perr&Knight’s StateFilings.com platform, our state filings experts will submit the change on your behalf, eliminating your risk of falling behind or slipping out of compliance. Using an online dashboard, you’ll be able to see in real-time which adoptions have been filed and which are pending submission.

Why automate your state filings?

As technology becomes faster, smarter and more secure, it makes sense to outsource to machines the tasks that require lower levels of human discernment. Standard bureau adoption filings are an excellent function for automation because the process requires the management of numerous minor but important details, instead of critical decision-making, which is better suited for people. This approach frees up time and attention for your teams to focus on more complex product compliance tasks. Bureau Maintenance is simply that—maintaining bureau-based products in real-time, rather than being forced to play major catch up down the road.

Read more: Expert tips to speed up state filing approvals.

Updates that matter to you

Because your Bureau Maintenance profile will be unique to your company, you’ll be alerted to only those filing requirements that apply to you. Based on the lines of business you follow, your adoption status, and programs in the states where you operate, you’ll know exactly which circulars need to be adopted via a state filing. This eliminates the need for manual scrutiny of each published circular by your staff.

Even for companies that don’t seem overwhelmed by filing updates, Bureau Maintenance can protect you from the risk of non-compliance. For example, affiliating with an auto-adopt or file-on-behalf status will likely minimize your number of filings. However, in cases of the states that prohibit auto-adoption, you are required to pay attention and submit your filings accordingly. Bureau Maintenance will ensure that nothing falls between the cracks. On other hand, if you have the opposite bureau affiliation profile — i.e. you have adopted loss costs, rules or forms from a particular bureau at single point in time and don’t intend to make updates— you could still be on the hook for mandatory changes if the bureau adjusts its materials based on regulatory changes. Once again, Bureau Maintenance will make sure that you keep current and compliant.

Read more: How to streamline bureau monitoring.

Maximize your resources

We deliberately created a competitive pricing structure for Bureau Maintenance because this ancillary service is designed to work in conjunction with your in-house teams. As a result, offloading the time-consuming tasks to automated software will increase the efficiency of your human capital on the revenue-generating tasks that forward your business objectives and competitive advantage.

Bureau Maintenance takes away the final piece of worry regarding the management of bureau adoption state filings. By letting dedicated software pay non-stop attention to bureau updates that impact your filings, you reduce the risk of overloading your internal teams or slipping into non-compliance. In an era where more and more businesses are capitalizing on the advantages of improved technology, automating these simple tasks just makes sense.