The term “loss pick” is used very loosely in the insurance industry and is not well defined. The expert actuaries at Perr&Knight are here to clarify the definition and provide more insight into how loss picks are derived.

Over the years, our actuarial consulting experts have narrowed down the definition of a loss pick to this: the projected ultimate loss ratio for the upcoming policy period, i.e. the future period where an insurance program of interest will begin to place new business on the capacity provider’s admitted / non-admitted insurance company paper.

This definition could also include defense and cost containment expenses (“DCCE”) and / or adjusting and other expenses (“AOE”), which are the newer names for allocated loss adjustment expenses (“ALAE”) and unallocated loss adjustment expenses (“ULAE”). However, more often than not, a loss pick usually refers only to the loss ratio without any loss adjustment expenses (“LAE”).

Historical Program Data

The most common way to derive a loss pick is to utilize the historical premiums, losses, and claims of the underlying insurance exposures to develop a projected loss ratio using standard actuarial techniques. That is, developing the losses to ultimate, trending them to the prospective policy period and dividing them by earned premium at the current rate level (adjusted for any historical rate changes, changes in underwriting, claims handling, prospective exposures, etc.).

However, too often this data is not available, so alternatives are required to calculate an appropriate loss pick.

Industry Data

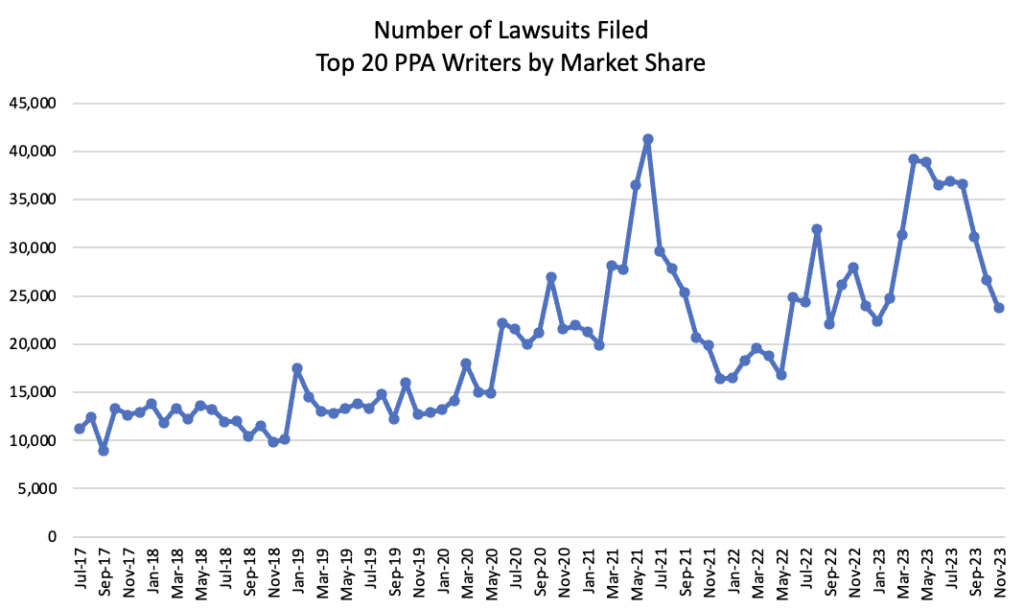

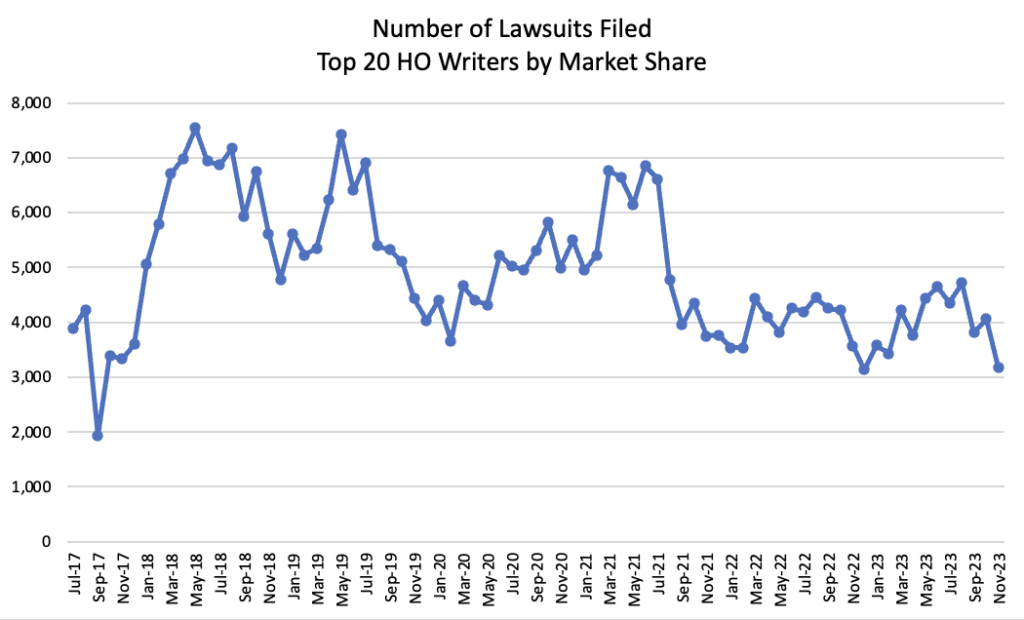

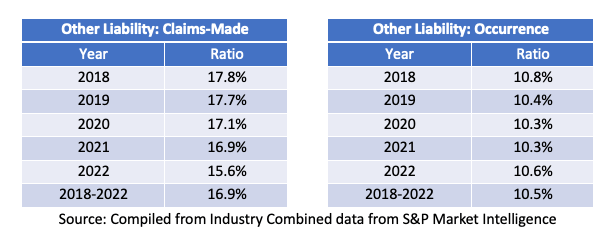

In some situations, industry data can be used as premiums, losses and underwriting expense information is publicly available in Statutory Page 14 and/or the Insurance Expense Exhibit (“IEE”) for many lines of business for each admitted / non-admitted insurance carrier. This data can be helpful to better understand which carriers are profitable, especially if the company’s line of business of interest falls under one of the specific lines broken out on these statements.

Granted, this data has some flaws, as any information is generally not program-specific. For example, “Other Liability” – line 17 on these statements – will likely have commercial general liability experience, but it will also be muddied with other types of business that fall under this line, such as contractual liability or professional liability.

Competitor Programs

Many times, a new venture will try to emulate the admitted rating plan of a well-known competitor in the industry as a starting point.

The underlying data for most admitted programs are usually publicly available via the state filings process. These filings may include historical premium and loss experience that is program-specific, which can be used to help identify if the program has been historically profitable for a very niche type of business.

This information, in combination with the industry data noted above, as well any adjustments for program deviations, can help draw conclusions on the appropriate loss pick for your program.

Rating Bureaus

Bureaus such as the Insurance Services Office (“ISO”) or the American Association of Insurance Services (“AAIS”) perform rate reviews annually, resulting in loss costs that are considered adequate for lines of business such as commercial auto, commercial property, commercial general liability, etc. These can be used as a starting point when developing a loss pick.

The company can load in target underwriting expenses and a profit provision to derive a loss cost multiplier (“LCM”) to bring these loss costs to appropriate premium levels.

In addition, both rate and form enhancements can be added to assist with your competitive position, helping to achieve a better rate for the risk and maintaining profitability.

A loss pick in this scenario is derived from the selected target expenses and profit load, as the base bureau loss costs are considered an adequate staring point at the onset.

The Internet

When all else fails and no data is available from the other sources mentioned, the internet is full of information that can help derive appropriate frequencies and severities for your niche business. Once obtained and found to be actuarially sound, they can be used to develop a loss cost (similar to the bureaus) and loaded with an LCM to derive a loss pick.

Underwriting Expenses & Profit Load

As part of the loss pick discussion, you will also likely have to address target underwriting expenses and profit load. Target underwriting expenses are defined as commission, taxes/licenses/fees, other acquisition expenses and general expenses. A factor of 1.000 minus these underwriting expenses, a selected profit load and LAE, is the initial target loss ratio. This initial target loss ratio will likely need to be supported using standard actuarial techniques.

The Benefits of Actuarial Consulting Partners

Deriving a loss pick is not a simple calculation. Applying the myriad of data points available – and knowing the best sources when some data sets aren’t available – is one of the advantages of working with experienced actuaries. The actuarial consulting experts at Perr&Knight have identified various methodologies to help with the derivation of an appropriate loss pick for your program that will be reasonable and supported using the described methods to assist with your new business venture.

Contact Perr&Knight today to get started.