2023 Florida Tort Reforms – What You Need to Know

- Written By Casey Tozzi

In an effort to address affordability in the personal auto and homeowners markets, Florida has recently enacted significant reforms that have dramatically changed the tort law applicable to personal insurance policies in the state.

Our actuarial consulting experts break down what this means for insurance companies and in the years ahead.

ATTORNEY INVOLVEMENT HAS BEEN SIGNIFICANT IN FLORIDA

For the past 50 years, Florida has been a no- fault state, where drivers rely on personal injury protection (“PIP”) coverage from their own policy to cover the cost of their injuries in exchange for a limitation on their ability to sue. Despite this intended limit, Florida’s PIP claims have been nearly three times as likely to be litigated as in other states1.

Litigation is also a major cost driver in the property insurance market. In 2020, Florida accounted for only 9% of countrywide homeowners insurance claims but a whopping 79% of all homeowners insurance lawsuits2.

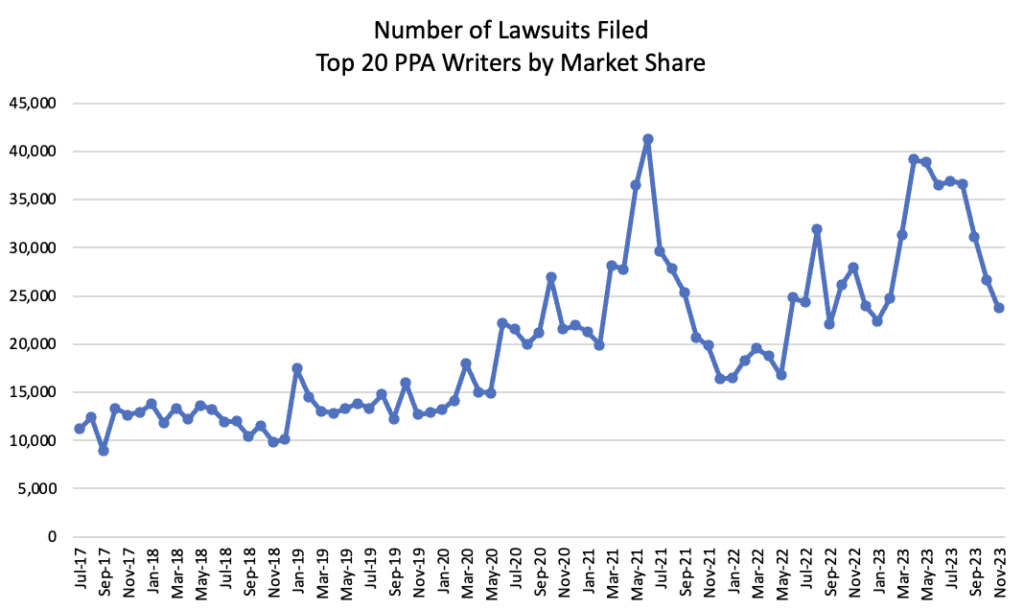

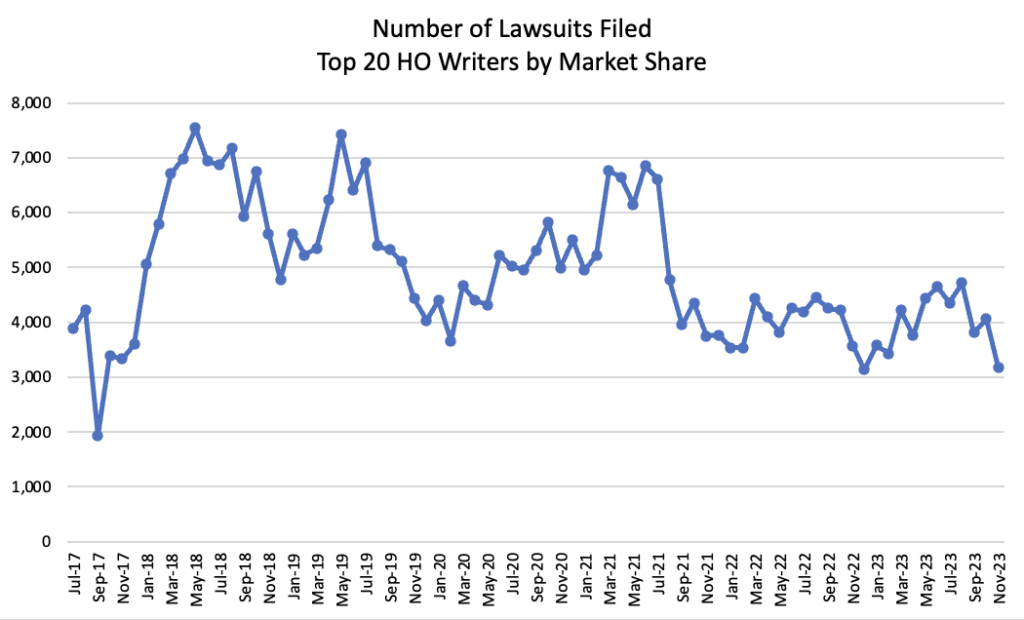

Exhibits 1 and 2 below show the number of lawsuits filed against the top 20 personal auto and homeowners insurance carriers in the state of Florida, respectively.

Exhibit 1

Exhibit 2

REFORMS DESIGNED TO REDUCE COSTS

Florida’s recent reforms include: Senate Bill 2A (“SB2A”), passed in December 2022, and House Bill 837 (“HB 837”), signed March 24, 2023. SB2A eliminated one-way attorneys’ fees and prohibited the assignment of benefits for residential or commercial property insurance policies written January 1, 2023 or later. HB 837 extended this by eliminating one-way attorneys’ fees in all but some declaratory judgments. In addition, HB 837 introduced new requirements for plaintiffs to recover damages. Most notably, it makes Florida a modified comparative negligence state, which prohibits claimants that are more than 50% at fault from recovering damages. It also reduces the statute of limitations for negligence claims and provides additional standards for bad-faith actions.

IMPACT ON RATE FILINGS

Due to the prospective nature of ratemaking, rate filings now need to consider the new tort environment. Historical data alone will not be sufficient to project future losses. There is a high degree of uncertainty since the reform will influence attorney and plaintiff behavior in response to the new laws.

These new patterns will take time to emerge, given claims with attorney involvement take longer to be adjudicated. These reforms are expected to reduce both the percentage of claims that are litigated and the average claim severity since non-litigated claims cost less than litigated claims. Lower payments will be made to plaintiffs’ attorneys, and the insurer’s defense and cost containment expense should also be reduced since fewer claims will need to be defended.

The Florida Office of Insurance Regulation commissioned studies to determine the potential impact of changes for some past reforms, but no study is available yet for these recent reforms. Insurers must evaluate the anticipated impact of the reforms on their losses and loss adjustment expenses and reflect this in their rate filings. Experienced actuarial consulting partners like the team at Perr&Knight can provide support to inform rate filing changes.

Private passenger auto rate filings open on or after July 1, 2023 have been required to submit detailed data to estimate the effect of HB 837 and to make necessary adjustments in the filing. Similarly, homeowners rate filings submitted after July 1, 2023 have been required to reflect projected savings due to the combined effect of several reforms over the past two years.

We keenly understand the data requirements and reasonable projections to provide the support that is needed. Let Perr&Knight’s team of expert actuaries use our proven experience to assist with your Florida rate filing needs.

Contact Perr&Knight today to learn more.