California Releases COVID-19 Company Reports – $1.2 Billion in Premium Refunds Reported

- Written By Perr&Knight

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. The Bulletin also required companies to provide a report outlining the details of the company’s response to COVID-19. These reports have been made publicly available by the CDI. Perr&Knight has aggregated detailed information from these reports from all the reporting companies and continues to assist companies with estimating the impact of COVID-19 on their insurance programs.

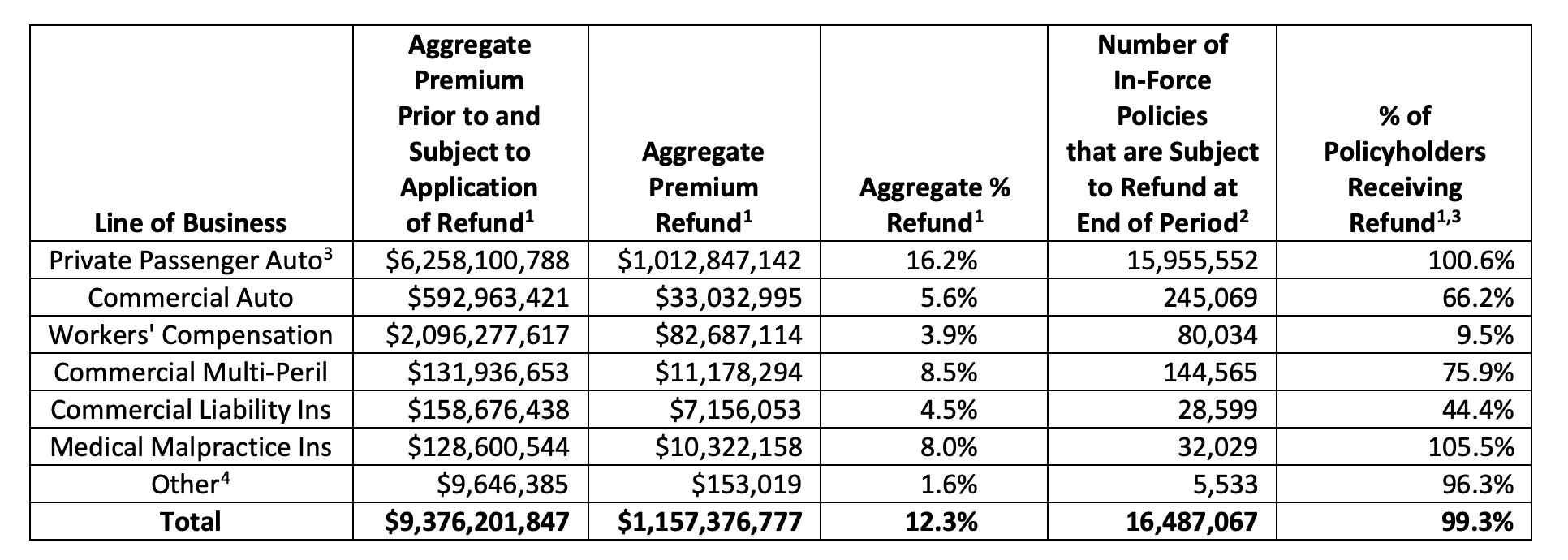

The following chart summarizes the reports available as of June 26, 2020 by line of business:

Table 1: Summary of Premium Refunds, Credits and Reduction

-

-

- Premium refunds include refunds, credits, reductions and policyholder dividends.

- For companies that provided policy counts by month, the same policies in effect during multiple months will be counted more than once.

- The percentage of policyholders receiving a refund is greater than 100% when refunds are issued to policyholders that were not in force at the end of the data period (e.g., canceled or nonrenewed).

- Private Passenger Auto is personal auto, although some companies reported motorcycle, motorhome and collector car program data as Other.

- Any other line of insurance that is impacted by COVID-19 pandemic

-

As indicated in Table 1, $1.0 billion in premium refunds have been reported to the CDI for personal auto policyholders. This line represents 88% of the total refund dollars reported. Companies representing 99% of the 2019 statewide written premium for the private passenger auto line of business have submitted reports. For the top 20 carriers in terms of market share, the smallest premium refund for personal auto is 15%, which was done by multiple carriers, and the largest premium refund was 27.5% by State Farm. State Farm also amended their pending rate filing and increased the proposed rate decrease from -2.1% to -6.5%. Assuming other companies do not offer additional premium refunds for future months, the GEICO companies are offering the largest portion of return premium to policyholders as they are offering a 15% discount on premium for the full policy term at renewal as opposed to offering the refund or credit for a few months of the prior term.

Additionally, in response to the CDI’s request, several carriers withdrew pending rate increase filings for their personal auto programs including withdrawals from the following companies below:

- 21st Century Insurance Company: +6.0%

- California Automobile Insurance Company: +5.0%

- Esurance Property and Casualty Insurance Company: +6.9%

- Mercury Insurance Company: +4.0%

- The Wawanesa General Insurance Company: +6.8%

Companies representing 1% of the California 2019 written premium for private passenger auto lines indicated that no refunds were being provided. The reasoning for not applying refunds was generally due to the inadequacy of the current rates, the lack of credible data for programs with very few insureds or the nature of the risk (such as for collector car programs).

As for the methods used to compute the premium refund for personal auto, over 70% of the companies used an average percentage based on estimated change in risk and/or reduction in exposure. Another 18.5% of the companies adjusted the miles driven for the rated exposure while the other companies used other methods. Of the companies who indicated an average percentage based on the estimated change in risk or reduction in exposure was used to determine the refund, 91% stated that a 15% average percentage was being applied for one or more months.

For commercial auto, the aggregate percentage refunds are less than personal auto and vary depending on type of business written by the company. The companies who have reported refunds represent 57% of the 2019 written premium in California. State Farm issued premium refunds of 27.5% for commercial auto, which equals their premium refunds for personal auto. Progressive, the largest commercial auto writer in California, had overall premium refunds amounting to 24.4% of subject premium. Great West Casualty had a premium refund 7% on their truck program and stated the following in their response to the CDI: “refunds, or premium accommodations, to insureds are made on a case-by-case basis depending on the insured’s operations, exposure, and premium calculation program.” California Automobile Insurance Company (“Mercury”), which is another top 10 commercial auto writer in California, provided a refund of 10.0%. Travelers, also a top 10 commercial auto writer in the state, reported a premium refund of 7.9%. However, Travelers mentioned it is “providing premium relief…on a case-by-case basis.” They further mentioned that they are expanding their “seasonal lay-up credit” and are waiving the 60-day minimum requirement for the credit. This will allow policyholders to suspend coverage on some or all of their operations for liability and collision coverage, which Travelers stated “will provide insureds a credit of at least 15% of the vehicle’s premium on an annualized basis.” For Travelers transportation book, they are applying “a “limited use” classification which reclassifies vehicle(s) and applies an approximate 60% credit on vehicles moved from “full use” to “limited use” during the period that the risk is impacted.”

The second largest amount of premium refunds reported to the CDI was for workers compensation policyholders. The reported information for workers compensation had 71% of companies indicating that refunds are determined based on “reassessment of the classification and exposure bases of affected risks on a case by case basis”, which is one of the checklist options on the CDI questionnaire. Of responding workers compensation writers, 59% indicated that a reduction of the rated exposures to reflect actual or indicated exposures based on payroll was used to compute the premium refund.

For the other lines of business required in the reports (Commercial Multiple Peril Insurance, Commercial Liability Insurance, Medical Malpractice Insurance and any other line of insurance that is impacted by COVID-19 pandemic), responses from the companies were more varied depending on the nature of the underlying policy. These lines represent less than 2% of the premium refunds reported to the CDI.

For the companies issuing premium refunds, the table below displays the methods by which the company is accomplishing this for the line of business.

Table 2: Summary of Premium Refund Methods

-

-

- Many companies (33% of respondents for private passenger auto) indicated that the refund is being achieved both through a return of premium and a premium credit. The method used for a specific policyholder could depend on things such as whether or not the policy is still active, the payment plan, etc.

- Sending payment (checks, credit back to credit card, etc.) to policyholders for the amount of the premium adjustment.

- Giving a credit at the next installment or renewal equal to the amount of the premium adjustment.

- Reducing the premium amount payable at the next renewal.

- Refunding an amount as a policyholder dividend.

-

In addition to offering premium refunds, most companies are taking other measures to help policyholders during the COVID-19 quarantine period. The table below summarizes the methods indicated by the companies responding for each line of business:

Table 3: Summary of Other Measures

As mentioned, the information compiled above is from reports available on the CDI website as of June 26, 2020. The CDI continues to add reports to the site. As of June 30, 2020, an additional 40 reports had been added. Six of these were resubmissions that have no significant impact on the refunds summarized in Table 1. The remaining additional reports include an additional $53 million of premium refunds, with the majority (77%) for workers compensation policyholders and most of the remainder (19%) for commercial auto policyholders.

The CDI has issued a Bulletin that extends the directives of the prior bulletins (Bulletins 2020-3 and 2020-4) through June and to any subsequent months where COVID-19 continues to result in “projected loss exposures remaining overstated or misclassified.” The new Bulletin includes the following reporting dates for insurers:

- October 1, 2020: Premium relief provided to policyholders for the months of June, July and August (as conditions warrant); and

- January 1, 2021: Premium relief provided to policyholders for the months of September, October or November (as conditions warrant).

The Bulletin further states the following: “Insurers shall continue to provide premium relief information to the Department on a quarterly basis for any future months in which a premium adjustment is Provided.”