Adapting to change, driving change: Insurance companies keep their competitive edge sharp with BPM

- Written By Wayne Snell

When a well-known Fortune 500 insurance provider needed a change agent to increase efficiencies in its growing operations, it turned to a four-person team and a business process management (BPM) solution for help.

The company needed to maintain its hallmark level of customer service and improve operations while managing the growth of a burgeoning company with more than $59.8 billion in assets. The BPM team introduced new process improvement technology to the company’s wellness claims group, which worked with more than 400,000 external account relationships billing on a biweekly or monthly cycle. And, after the first 90 days of the BPM project, their payroll reconciliation costs shrunk by 12 percent.

Similarly, Xbridge offers insurance in the UK to small business, landlords, shops and restaurants. While smaller in scale than the example above, Xbridge faced similar issues. In just 18 months its call center staff grew from only six people to more than 50, and the company’s manual processes were breaking down as the organization grew.

Managing that dramatic growth has been a driver for the adoption of BPM. With BPM, people understand where they fit into the process and how they impact the customer. With BPM, management receives performance metrics in real time allowing them to make critical decisions that they couldn’t have made previously.

Insurers like these are turning to BPM in growing numbers to reduce expenses, gain greater efficiencies in processing and managing claims, add new products and services, deal with regulations, and maintain an edge against their competitors.

And now with the global financial community completely turned upside down and a government overhaul underway, the insurance industry will more than ever before look for ways to better manage their operations and overcome new adversities in the market. BPM will no doubt play a vital role in this effort.

The idea behind BPM is to systematically improve an organization’s business processes. BPM software helps to make business processes more effective, more efficient, and more capable of adapting to an ever-changing environment. If executed properly the results of a successful BPM project can be enormous.

For example, one large U.S. insurance provider deployed a process to optimize invoice reconciliation and was able to reduce the error rate of handling paper invoices by 30 percent. Another streamlined customer service processes that spanned four business groups, increasing workload capacity by 192 percent.

BPM is one of the fastest growing software categories on the market. In a recent survey of 1,400 CIOs by Gartner Executive Programs, the top business priority identified by CIOs was business process improvement. For individuals or organizations that are being asked to investigate process improvement, BPM is a term that frequently associated with the process improvement.

The insurance industry has quickly adopted BPM as a means to serve not only as a solution to specific, immediate process improvement objectives, but as a platform that gives them the ability to tackle diverse process improvement initiatives and realize the following benefits:

- Enable collaboration across and beyond the enterprise. Automatic work routing and notifications across groups, outside agents, and customers reduces the time, errors and complexity of executing processes.

- Enable Straight-Through Processing. Business rules in processes can help automate the routing and processing of tasks – often reducing the amount of human intervention needed by over 80 percent.

- Gain real-time visibility and control over processes. Managers can view real-time process performance and proactively manage bottlenecks.

- Extend the value and life of core systems. Leverage existing applications by reading and posting transactions while introducing more efficient Web-based forms and interfaces.

- Ensure that the process that is documented – is the process that is executed. Process models that actually run the process provide consistency, adherence and audit trails to ensure compliance with regulations like SOX, HIPAA, etc.

- Respond to change faster. Revise processes to respond to organization or regulatory changes – in days, if necessary.

BPM broken down

BPM is the understanding, visibility and control of business processes. A business process represents a discrete series of activities or tasks that can span people, applications, business events and organizations. Based on this definition, you could logically relate BPM with other process improvement disciplines. That assumption is valid – there is certainly a described process (or methodology) that should be followed to help an organization document their business processes and understand where they are being used throughout their business. During discovery, everyone agrees on how the current process is defined. The ‘as-is’ process is then used as a basis for determining where the process can be improved.

However, simply documenting what the process looks like does not give the business managers (those responsible for the actual results) control over the process. The real value of BPM comes from gaining visibility and control of the business process. By applying technology, BPM software can activate the process, orchestrate the people, data and systems that are involved in the process, and give the business managers a view into how the process is operating, where bottlenecks are occurring and highlight possible process optimizations. Process operational metrics are automatically collected by the BPM software. Business metrics and key performance indicators (KPIs) can also be measured to add specific process or organizational context to the data.

Armed with data on how the process is currently operating, business managers can use any process improvement technique to optimize the process. The next generation process will drive maximum performance and efficiency. The impact of an improved business process can be realized in many ways, including reductions in cost, improved customer satisfaction, increased productivity by allowing reallocation of resources to more value added tasks, or by compliance with industry or regulatory requirements.

The description above represents the promise of BPM – process ‘nirvana’. Most companies are far from achieving this level of process capability. Business managers have limited visibility, especially for processes that may cross outside the borders of their department or extend outside the organization. Individual work activities may be processed in a first in – first out fashion, rather than being based on an optimized global prioritization. For organizations that have expanded or grown by acquisition, each business unit may perform similar processes, but each completing the work using specialized processes that don’t allow sharing of human and technology resources. Not knowing the current status of work paralyzes the business because managers cannot predict when work will be completed, who will complete it, if there are problems and how much the work is costing the company.

The term “Process-Driven” means that a person or organization has a passion for superior business performance through process innovation. Process-Driven organizations are those that understand how their work is getting done and focus on finding opportunities to make it better. They focus on the business and the results. They leverage technology, process improvement methodologies and best practices while embracing change to drive the processes that support their business. BPM is a business-oriented architecture that allows process owners to set improvement goals and orchestrate actions across the company to achieve those goals.

The evolution of process technology

The term BPM has evolved from a history of usage in related business process fields such as business process improvement, business process reengineering, and business process innovations. Just as these process disciplines have changed, BPM systems or suites have evolved similarly to other management systems. These advances can be mapped at the lowest level to the technology itself. Understanding these relationships is important to help ‘place’ a BPMS in the hierarchy of an organization’s systems.

The operating system of the computer is an example of the very lowest level of a management system. Database management systems (DBMS) are the primary controller of data. Widespread use of computers in business heralded business applications that managed functional areas. At this point, organizations found that the data that supported their business was organized in silos, driven by the functional applications adopted by the company. Examples of these types of applications include Enterprise Resource Planning (ERP) Systems, Customer Relationship Management (CRM) systems and Order Management (OM) systems.

Organizations found themselves with a ‘four wall’ scope. It was difficult to share data and work between different departments because the applications enforced a department-level scope. Unfortunately, most business processes spanned systems, departments and sometimes external business partners. In addition, businesses were forced to operate the way the application was developed, rather than by the way they defined their own processes.

These applications were difficult – if not impossible – to modify, and it was typically a lengthy and costly undertaking. Technology came to the rescue again, and tools like workflow management systems and Enterprise Application Integration (EAI) suites were introduced. These tools allowed work and data to be routed and synchronized across an organization, but they simply served as conduits. It was difficult to tie the activities back to a higher level business process. However, they did serve as an enabler of BPM because they provided cross-system accessibility.

BPM evolved because of an increase in process focus. Organizations realized that they could set themselves apart from their competition by optimizing their business processes. BPM suites are integrated software facilities that enable organizations to adopt and implement business process management. They foster process characteristics like efficiency, effectiveness, and agility. In order to accomplish this, they must contain features that support the following:

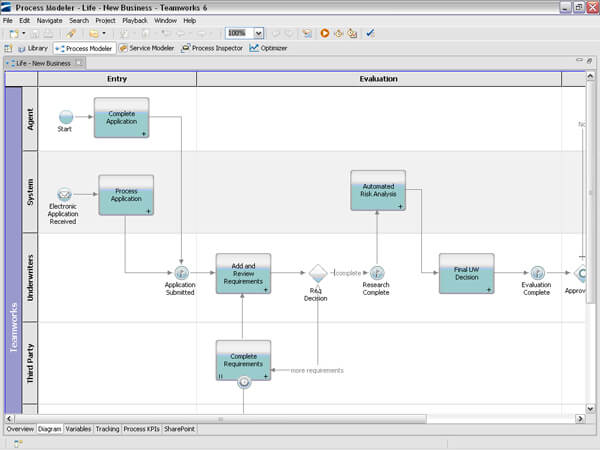

- A graphical modeling capability that can be used by both business owners and process analysts to create both workflow components and higher-level business processes. Modeled processes should include human resource parameters, business event definitions and system activity steps.

A graphical process modeling environment

- The ability to simulate one or many business processes, using test, historical and in-flight process data.

- A facility to create user interface forms and reports.

- A facility to create business process rules and allow their use to drive process flow and decisions.

- The ability to integrate with external systems, including many standard technologies or systems.

- The ability to send and receive business and system event messages.

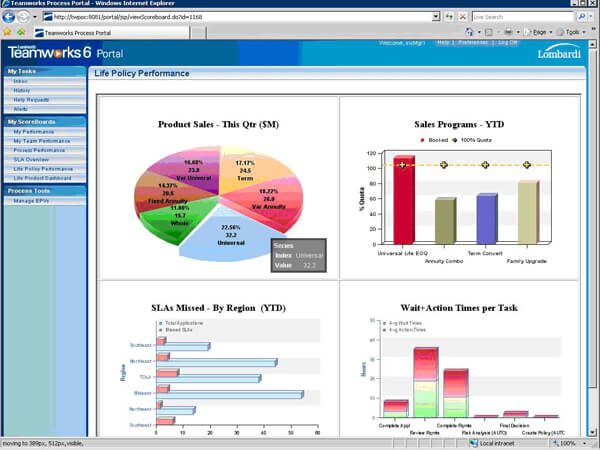

- An embedded capability to capture and manage process performance and business indicators as they correlate to the business processes being executed.

- The ability to create graphical scoreboards for reporting business process metrics in real-time (also referred to as Business Activity Monitoring or BAM).

A graphical scoreboard from a leading BPM suite

- A shared business process repository to house all process and process-related artifacts

- Tools for the administration of the business process engine or server.

Where does BPM fit?

The adoption of BPM by insurance providers and brokers involves a major shift in the way their organizations will operate. BPM technology and best practices and methodologies associated with it cannot be assigned solely to the IT staff. The organization’s leadership team must demonstrate a commitment to BPM and its benefits in order to effect change and adoption throughout the organization. Change is never easy, but with BPM, the benefits can be easily demonstrated to build momentum throughout the organization.

First and foremost, organizational leadership and business managers must take ownership of the business processes that support the company and their specific organizational groups. These organizational groups are responsible for the performance of the company.

BPM enables them to start small, achieve outstanding process results and optimizations in a pilot project, and then apply the technology to other projects. In fact, deploying a process “as is” in a BPMS can – without making any other changes – lead to a twelve percent productivity improvement. This significant gain just sets the stage for further improvement. The ease with which an organization can deploy a new process or update an existing process is a key differentiator in a BPM suite.

A BPM suite that offers a shared process repository will enable all groups within an organization to leverage the process successes that have already paved the way for BPM adoption. In addition, it is essential that insurance organizations adopting BPM employ a more iterative approach to the development and delivery of process applications. Because processes change so frequently and because new requirements emerge as process improvement expands across organizational boundaries, an iterative development approach has proven to be the most successful model for delivering process applications.

Of course, an insurance IT department must be willing and able to integrate and support the BPM technology. This is simplified by the fact that most leading BPM solutions are themselves service-oriented and fit into a Service Oriented Architecture (SOA) seamlessly. In fact, BPM implementations are often the leading “consumers” of the services made available by SOA initiatives – providing concrete business value and impact. Furthermore, the Object Management Group (OMG) is actively driving the definition and adoption of industry accepted standards for all aspects of BPM functions. This eases the IT adoption of the technology by increasing the interoperability of your processes as well as the portability of technology assets. For companies already using process improvement methodologies like Six Sigma or LEAN, a BPM suite adds new measurement and control capabilities that help scale the application of process improvement methodologies across the entire organization.

Insurance organizations that have been successful with making BPM an integral part of their way of doing business have often decided to create BPM Centers of Excellence (COE). At inception, the COE may have been part of the IT organization, but as the enterprise evolved into a more process-driven entity, the COE became a more structured group of individuals that could contribute to BPM projects for the entire organization.

Gartner reports common themes of COE charters to include:

- Streamline internal and external business processes

- Maintain control and accountability

- Provide end-to-end visibility

- Increase automation

BPM-related services that the COE can provide to the organization include:

- Coaching and facilitating

- Promoting best practices

- Delivering process training and education

- Maintaining a business process knowledge base

Regardless of how an organization decides to implement BPM, it is important to build momentum by making process successes visible to all levels of the organization. Groups and individuals in the organization will become aware of contributions they can make to the organization by leveraging BPM to optimize their business processes.

Typical insurance process challenges

All insurance companies, regardless of the market segment they serve, share common processes, including business and market development, product development and maintenance, product promotion, and distribution. The processes that would most benefit from BPM, however, vary by segment and according to product types offered by the company.

Accordingly, each market segment has different processes that they would like to improve. The priority assigned to improvement efforts may be based on transaction volume, complexity of work, error rates or overall client pain. Examples of business processes that are prime candidates for business process improvement, by market segment, include:

- Life. Application submission, underwriting, policy issuance (new business), inquiry management, call center services, internet services (customer services), contract maintenance, policy loans (maintain contracts), billing, payment processing (collect premium), agent commission management (create/maintain distribution system) – prioritized by individual and group products (respectively)

- Healthcare. Manual receipt processing, claims data entry, claims manual adjudication, payment or denial, auto-adjudication, pend management (claim management), recovery of overpayment, claim adjustments/refunds/voids, subrogation (claim adjustment), group processing, membership processing, premium billings, billing/payment reconciliation (membership), claim status, verification of coverage, verification of benefits (customer services) – prioritized by group, managed care (HMO), individual, indemnity and dental products (respectively)

- Property & Casualty. First notice of loss, analyze coverage, conclude claims (adjudicate claims), submit application, underwriting, policy issuance (issue contracts), endorse policies

Success stories

Because of the variety, volume and mixed complexity of insurance-related business processes, opportunities for process improvement abound. Many insurance companies have adopted BPM suites to create competitive advantages in their businesses. While the areas in which they use such suites are varied, the results are predictable: process efficiency that provides quick and measurable ROI, outstanding visibility into the operational aspects of the processes, enabling further optimization and the agility to quickly identify and change business processes to stay ahead of the competition.

Xbridge, the United Kingdom’s leading online insurance and finance broker, turned to BPM to adapt to the rapid growth the company was experiencing. A small company of a little more than 120 employees, Xbridge competes and usually wins against bigger names in the industry. Unlike large organizations that implement BPM with a legacy system, Xbridge brought in BPM to automate its existing manual process of processing and responding to leads.

Three years ago, Xbridge managed more than 1,500 inquiries a month in the company’s call center of six employees, which provides an alternative to potential customers who prefer to work with a person instead of online. Conventional wisdom at the time implied that every inquiry was a potential lead and should receive a personal response. However, within a week of automating the process with BPM, they discovered that was not the case. Today Xbridge manages more than 20,000 inquiries a month with a staff of 60 employees in their call center. With automation, the response to inquiries has improved greatly; in addition, Xbridge is able to better qualify inquiries to determine which merit a personal response, based on their ability to offer the prospective customer an appropriate product.

For another Fortune 500 insurance provider on the opposite end of the size spectrum, invoice reconciliation posed a process management challenge. Of the approximate 500,000 monthly invoices sent to customers, up to 30 percent would be disputed in some way. The challenge for the reconciliation team was to resolve each dispute before the next billing cycle, typically a window of less than 30 days. If a dispute was not resolved by the next bill, the customer frequently disputed it again the following month, resulting in wasted effort and customer frustration.

By leveraging BPM, an invoice reconciliation process was developed and deployed in just 90 days. The initial deployment is well on its way to reducing by 80 percent the number of full-time equivalents (FTE) required to handle paper invoices. The BPM system provided the platform that enabled the process design required to automate task assignment, perform time and value-based prioritization and provide proactive notification and interactive approval controls, all in an integrated working environment.

The key takeaway from these examples is this: in a mature market like insurance, no process is off limits when evaluating the improvements that can be introduced by a BPM suite. Improvements that increase the efficiency, effectiveness and agility of existing processes enable insurance providers to outperform their competitors in both the cost to provide products and services and by offering outstanding service to both agents and end consumers.

Wayne Snell is Senior Director, Marketing for Lombardi Software, developers of the Teamworks Business Process Management Suite. Wayne manages all aspects of Lombardi’s public and customer communications. His more than twenty years of experience include senior-level marketing, product management and technical implementation positions with BEA Systems (now part of Oracle), start-up services provider Symphion, Viasoft (now owned by Allen Systems Group), and Computer Associates.